DBJ Sustainability Bond (Date of Issue:2016.10.19)

The net proceeds of the issuance of the Notes will be used exclusively to finance or re-finance, in whole or in part, existing and/or future Eligible Loans (as defined below).

"Eligible Loans" means loans e (i) loans extended by DBJ to companies that are rated A, B or C under the DBJ Environmentally Rated Loan Program, or (ii) loans extended by DBJ to finance or refinance buildings that are rated 3, 4 or 5 stars under the DBJ Green Building Certification program and which have not previously been the subject of the use of proceeds of DBJ's Existing Green Bonds and Existing Sustainability Bonds (as defined below).

"Existing Green Bonds" means DBJ's Series 53 EUR250,000,000 0.25 per cent. Notes due 2017.

"Existing Sustainability Bonds" means DBJ's Series 56 EUR300,000,000 0.375 per cent. Notes due 2019.

DBJ Environmentally Rated Loan Program is a loan program utilizing a screening (rating) system developed by DBJ that evaluates enterprises on the level of their environmental management and then sets financial conditions based on these evaluations. This was the world's first incorporation of environmental ratings in financing menus.

DBJ Green Building Certification is an environmental and social rating system created and applied by DBJ to measure the environmental and social awareness characteristics of real estate properties. DBJ Green Building Certification assesses the characteristics of a green building from perspectives such as ecology, risk management & amenity and community & partnership (please see the DBJ Green Building Certification for more information).

Sustainalytics PTE LTD provides an independent third-party opinion to the DBJ Sustainability Bond (please see the Opinion (PDF 967K)for the opinion).

The net proceeds from the issue of the Notes will be held and tracked in DBJ's treasury until they are allocated to Eligible Loans. So long as the Notes are outstanding, DBJ aims to allocate an amount equivalent to the net proceeds of the Notes towards Eligible Loans. Unallocated proceeds will be held in cash and/or a money-market portfolio which will be tracked by DBJ's treasury.

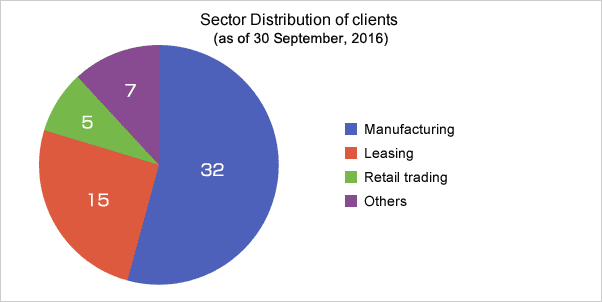

DBJ will disclose, on an annual basis, the total amount of loans provided under the Environmentally Rated Loan Program and Green Building Certification programs and the number of loans granted using the Sustainability Bond proceeds. In addition, in the case of the Green Building Certification program where it has received client’s consent, DBJ will disclose several case studies of green buildings underlying the loans allocated to Eligible Loans. In the case of the Environmentally Rated Loan Program, DBJ will report the sector distribution of clients and, in cases in which it has received a client’s consent, it may report project summaries and key factors evaluated on specific green projects undertaken or implemented by the client.

Eligible Assets for this DBJ Sustainability Bond will be loans extended from October 2015 to September 2016 and the assets are listed below. The total amount of the Eligible Assets for the Note is ¥253.0 billion (Approx. $2,502 million (¥101.12=$1)).

Eligible Assets

(i) DBJ Environmentally Rated Loan Program

(as of 30 September, 2016)

the number of Eligible Assets:59

the total amount outstanding:¥225.4 billion (Approx. $2,229 million (¥101.12=$1))

Case study

Toray Industries, Inc(Tokyo)

Manufacturing Company

Rating (DBJ Environmentally Rated Loan Program):A

Currency:JPY

Features of the Assessment

- Eco-products are integral to the Toray system. Using its original Toray Eco-Efficiency Analysis, the firm approaches product assessment from both the environmental and economic perspectives, the best products being given the Green Innovation (GR) designation.

- Toray pursues management principles, business strategy, and CSR in an integrated manner. As the principal midterm management issue outlined in its AP-G 2016 report, Toray promoted the Green Innovation Business Expansion Project, a growth strategy for GR products which sets forth numerical targets for expanding the sales of GR products and their contribution to CO2 emission reductions.

- Toray sends CSR questionnaires to suppliers accounting for at least 90 percent of its total amount of purchases and applies the findings in its subsequent initiatives. The firm works to improve its relationship with biological diversity throughout the entire supply chain, both upstream and downstream and in regard to both opportunity and risk.

Teijin Limited(Osaka)

Manufacturing Company

Rating (DBJ Environmentally Rated Loan Program):A

Currency:JPY

Features of the Assessment

- It utilizes ISO26000, GRI and other guidelines to select and prioritize a broad range of issues of importance to business management and corporate social responsibility, consulting with outside specialists in a management process focusing on materiality and quality of life.

- It has a designated line of “Earth Symphony” products planned with environmental considerations in mind. These were developed using an environmentally-friendly design checklist adopted in 2007, and are highly regarded for their combination of eco-functionality with a reduced environmental burden in the manufacturing process. Teijin is considering a further elevation of these standards.

- In its General Report, disclosing non-financial information on its main businesses, Teijin provided a clear explanation of the value provided by the carbon fiber and polyamide fiber that are its leading products. Based on a product road map leading up to 2020, it laid out a concrete vision for its mid-to-long-term contribution to business opportunities involving environment and energy as well as safety, security and disaster prevention.

Nikon Corporation(Tokyo)

Manufacturing Company

Rating (DBJ Environmentally Rated Loan Program):A

Currency:JPY

Features of the Assessment

- To address the pressing issues indicated in the group’s midterm management pIan, Nikon set up a CSR Committee under the leadership of the company’s Chairman. Reporting to this is an Ethics Committee and an Environmental Initiatives Committee. The corporate group works together to build a regionally sensitive framework for the consistent promotion of CSR and a sustainable society.

- The company is moving ahead with a new, group-wide personnel program, “Future in Focus,” with the aim of creating a favorable climate for national, ethnic, and gender diversity in hiring and training.

- Under the Nikon Green Procurement Standards and Nikon CSR Procurement Standards, the company works to minimize the environmental risks involved in procurement, including the problems of conflict minerals, human rights, and protection of confidential information. Management of the supply chain is exceptionally thorough, with guidance given for the improvement of due diligence and its findings.

Daiwa House Industry Co., Ltd.(Osaka)

Others

Rating (DBJ Environmentally Rated Loan Program):A

Currency:JPY

Features of the Assessment

- Based on its Mid-to-Long-term Environmental Visions, Daiwa House Group prepared an environmental action plan to be integrated with its business strategy. Aiming to minimize environmental burdens generated in the life cycle of houses and other structures, the corporate group promotes the creation, conservation, and storage of energy and the popularization of smart- and eco-products within a comprehensive energy management system, toward its goal of zero environmental impacts.

- Daiwa House Group is increasingly involving itself in environmental protection-oriented business. Its initiatives in the area of environmental stock include the improvement of building longevity and the renovation and resale of used homes. Others include environmental greening business aimed at promoting biodiversity in urban areas.

- The corporate group is taking a number of initiatives to achieve a CSR- and environmentally friendly supply chain, including the development of its own assessment guidelines for procuring wood and managing chemical substance and the preparation of comprehensive CSR procurement guidelines.

- In 2011, the corporate group utilized stakeholder meetings to identify matters deserving urgent attention from a broad range of issues involving CSR. In addition to reviewing its standards for CSR self-assessment, it regularly discloses targets and results based on established key performance indicators (8 themes, 18 issues and 40 indicators).

(ii) DBJ Green Building Certification

(as of 30 September, 2016)

the number of Eligible Assets:6

the total amount outstanding:¥27.6 billion (Approx. $273 million (¥101.12=$1)).

Case study

Hitachi Solutions Tower B/Morgan Stanley Capital K.K.

Rating(DBJ Green Building Certification 2016):3 Stars

Currency:JPY

Features of the Assessment

- Environmental Approach: Installing LED lighting at the entrance hall and using eco-friendly glass on the windows

- Disaster Preparation: Establishing emergency power generators and preparing stockpiles in case of emergency while participating in local emergency training

- Accessible Facilities: Providing tenants with good access to restaurants and convenience stores in the same building, besides also creating AED facilities and smoking area

| Location | Shinagawa-ku, Tokyo |

|---|---|

| Site Area | 8,716.80m² |

| Floor Area | 40,844.73m² |

| Number of stories | 23 stories above ground, 3 stories underground |

| Construction Completion | September 2002 |

Osaka Maishima Logistics Center/NISSUI LOGISTICS CORPORATION

Rating(DBJ Green Building Certification 2016):5 Stars

Currency:JPY

Features of the Assessment

- Environmental Awareness: Installing LED lighting in the whole facility and a highly efficient cooling system with natural cooling in efforts to reduce the impact on global warming

- One-Way Capital Method*: Being the pioneer of implementing this method in the refrigerated storage industry, thereby promoting more effective use of space by improving the pallet absorption rate through the reduction of the size and the number of posts while providing a large space for disposal of goods and the maximum capacity of 29 berths

- Disaster Preparation and Security Management: Building a base isolated structure and emergency power generators as disaster preparation and installing a face authentication system to limit building access for the security purposes

*One-Way Capital Construction Method: A new method which uses materials made of extremely hard concrete to put joist capital only in one direction instead of two

| Location | Osaka-shi, Osaka |

|---|---|

| Site Area | 24,726.95m² |

| Floor Area | 19,128.73m² |

| Number of stories | 5 stories above ground |

| Construction Completion | April 2016 |

Tokyo Danchireizo A・B Refrigerated Warehouses/Tokyo Danchireizo Co.

Rating(DBJ Green Building Plan Certification 2016):5 Stars

Currency:JPY

Features of the Assessment

- Energy Saving: Installing LED lighting in all warehouses and offices as well as a highly efficient cooling system with natural cooling

- Disaster Preparation: Establishing facilities with a base isolated structure and emergency power generators

- Community Awareness: Designing multiple gates and securing a waiting space to avoid creating a traffic jam after the reconstruction with the expansion of accommodation

| Location | Ota-ku, Tokyo |

|---|---|

| 【Warehouse A】 | |

| Site Area | 33,468m² |

| Floor Area | 98,013m² |

| Number of stories | 6 stories above ground |

| Construction Completion | February 2018 |

| 【Warehouse B】 | |

| Site Area | 13,882m² |

| Floor Area | 37,605m² |

| Number of stories | 6 stories above ground |

| Construction Completion | February 2018 |

Mitsui Shopping Park LaLaport TACHIKAWA TACHIHI/

TACHIHI HOLDINGS Co., Ltd

Rating(DBJ Green Building Plan Certification 2015):5 Stars

Currency:JPY

Features of the Assessment

- Environmental Awareness: Reducing environmental damage by using LED lighting in the exclusively-owned area

- Diversity Awareness: Establishing experience-based cultural facilities to provide opportunities for a variety of experiences and installing bathrooms designed for children and the elderly to accommodate a diverse group of needs

- Community Approach: Establishing a large public park and planting terrariums with the symbol tree

| Location | Tachikawa-shi, Tokyo |

|---|---|

| Site Area | 94,000m² |

| Floor Area | 154,000m² |

| Number of stories | 3 stories above ground |

| Construction Completion | November 2015 |