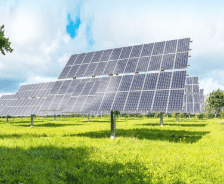

Sustainability

We aim to achieve economic value and social value through business activities

that are based on a business model that leverages distinctive features, including integrated investment

and loan programs and consulting advisory services to achieve a sustainable society.

that are based on a business model that leverages distinctive features, including integrated investment

and loan programs and consulting advisory services to achieve a sustainable society.

Integrated Report 2023

Integrated Report

We aim to achieve economic value and social value through business activities that are based on a business model that leverages distinctive features, including integrated investment and loan programs and consulting advisory services to achieve a sustainable society.

Sustainability News

Sustainability Management

This section introduces our concepts on sustainability management and policies for implementing sustainability management.

Resolving Social Issues and Creating Value Through Our Core Businesses

Resolving Social Issues and Creating Value Through Our Core Businesses

Collaboration with Stakeholders

Collaboration with Stakeholders