Asset Financing (Real Estate)

About Asset Financing (Real Estate)

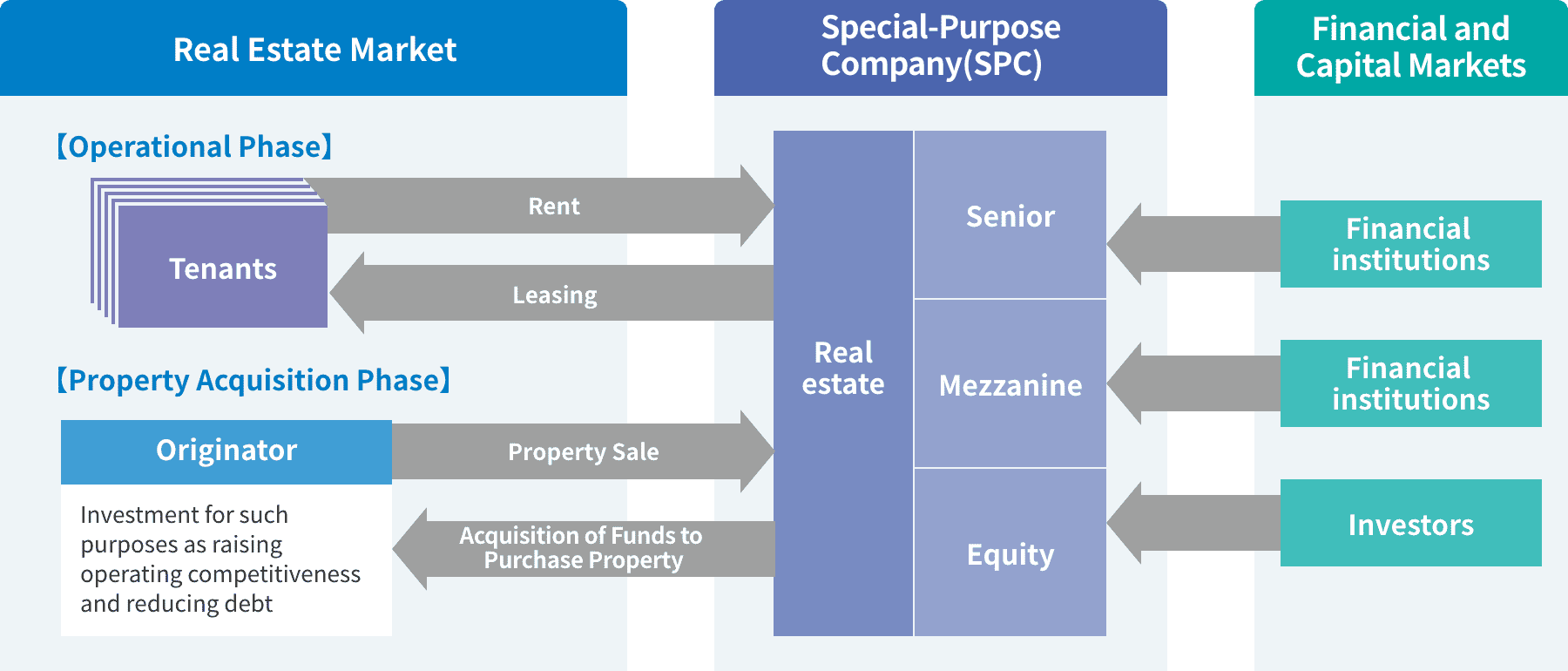

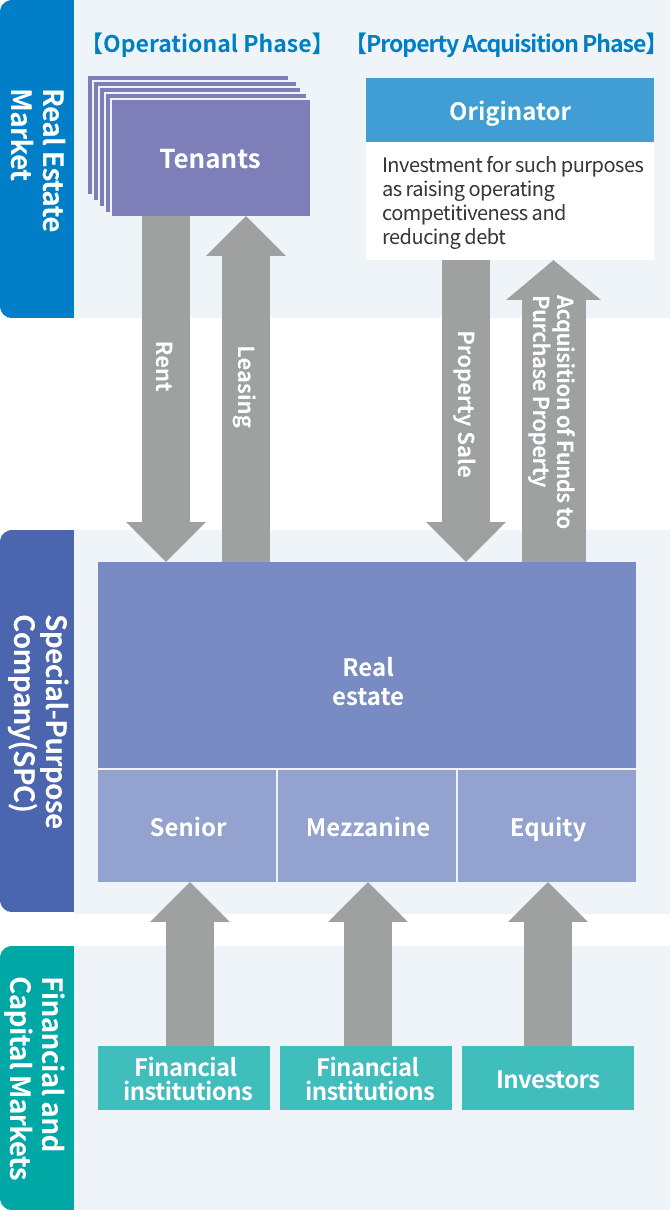

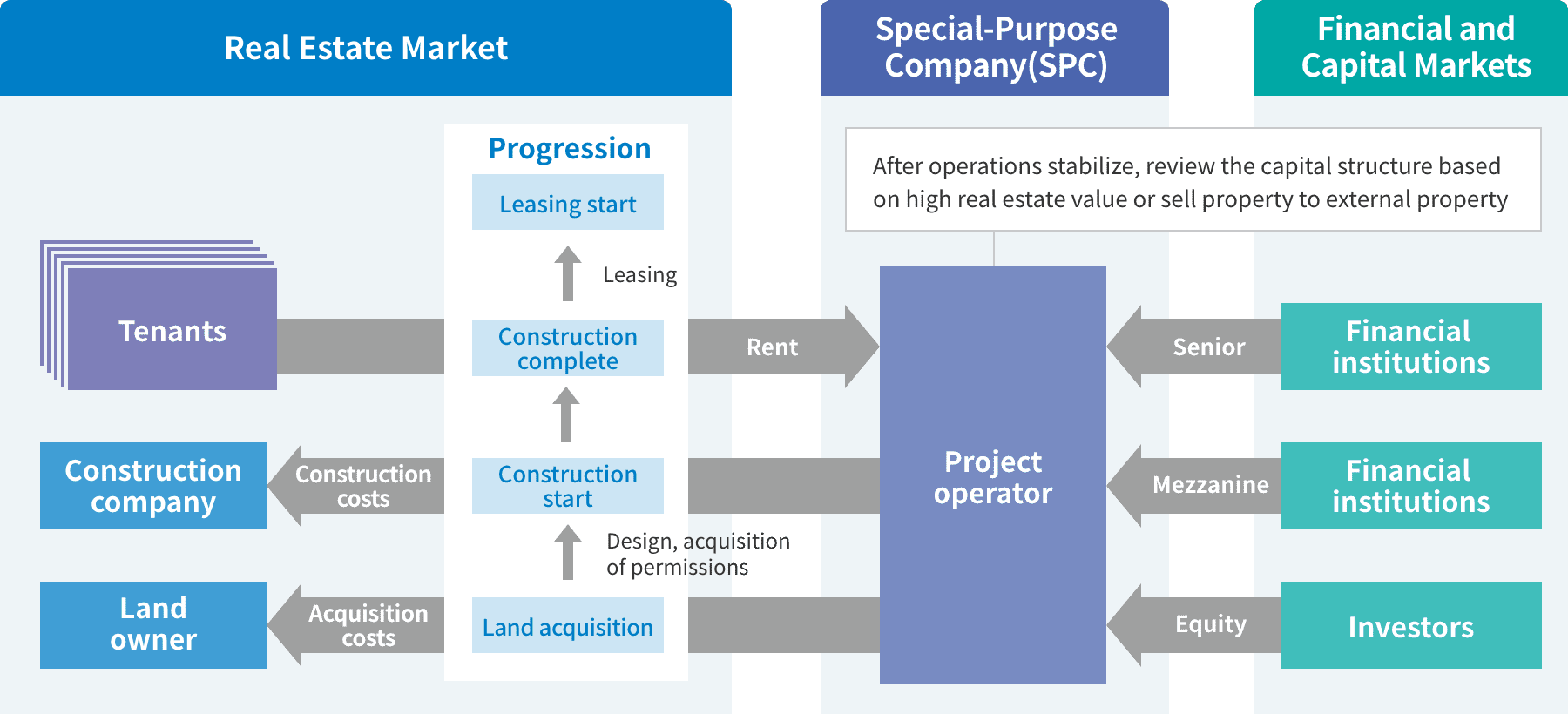

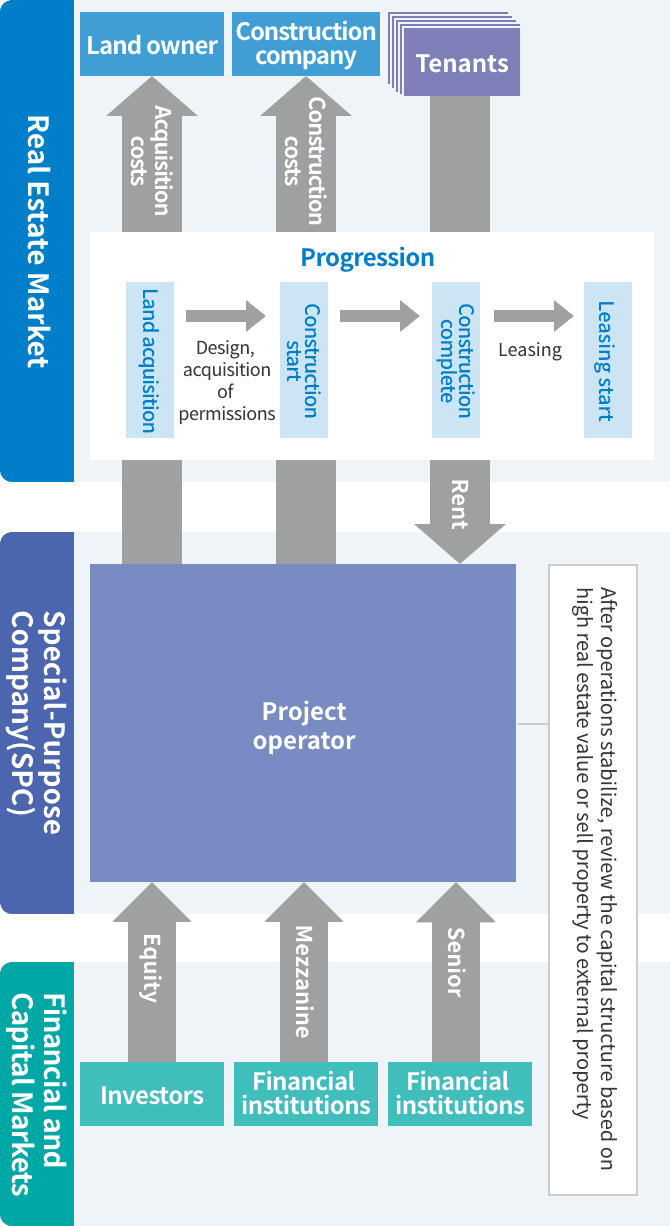

Asset finance (real estate) is a financing approach in which cash flows generated from assets owned by the company can be used as a source of funds for dividend payments and loan repayment. This approach consists of securitized finance, to improve capital efficiency via the sale of leased real estate to a special purpose company, and development finance, to maintain the soundness of the client’s financial health (balance sheets) by developing idle assets at the SPC and turning them into revenue-generating properties.

The benefit for customers includes the diversification of financing methods, improvement of financial structure by making off–balance sheet arrangements for target real estate, and separation of real estate price volatility risks.

DBJ provides unique services, including arrangement of financing that utilizes networks with leading investors and financial institutions in Japan and abroad; development of optimal financing schemes that correspond to projects; and, leveraging our position of impartiality, achievement both of reconciliation of disparate interests among related parties and of optimal risk allocation.

Scheme

Type of Operation | Liquidization Financing

- 1.

Example 1: After selling owned real estate that a customer is using to a special-purpose company, conclude new rental agreements and continue using the property in this manner.

- 2.

Example 2: After selling owned real estate that a customer is using to a special-purpose company, conclude new rental agreements and continue using the property in this manner.

Type of Operation | Development Financing

Example: Use investor financing to develop idle owned real estate into income property.

Related information

- Service

- Medium- to Long-Term Loans

- Structured Finance

- Asset Financing (Real Estate)

- Syndicated Loans

- Asset-Based Lending (ABL)

- Debtor-in-Possession Financing

- Crisis Response Operations

- Mezzanine Financing

- LBOs / MBOs

- Equity

- Collaborative Fund Operations

- Special Investment Operations

- DBJ Sustainable Solutions(Open in new window)

- DBJ Certification Programs

- DBJ Sustainability Linked Loans with Engagement Dialogue

- DBJ Green Building Certification

- The DBJ Visionary Hospital Program

- Regional Emergency Response Program

- M&A Advisory Services

- Support for Startups

- Support for Innovation

- Public Asset Management

- Asset Management