LBOs / MBOs

About Leveraged Buyouts (LBOs)

A leveraged buyout (LBO) is an M&A arrangement in which a company or business is acquired using borrowed money. If the company or business that is being acquired generates steady cash flows, the acquirer (typically, the sponsor providing equity) can reduce the size of its equity investment by financing the purchase to a large extent with borrowed money. Buyout funds, which actively use borrowed money to maximize return, are the main players in M&A LBOs.

About Management Buyouts (MBOs)

A management buyout (MBO) is the purchase of a company, its operations, or its assets by the company’s management team. Because the management team typically has a limited amount of cash available, in most cases it needs to procure a loan to acquire the business. Therefore, an MBO frequently takes the same form as an LBO. In some cases the total required funding cannot be procured through a loan alone; so, the management team partners up with a buyout fund to jointly provide equity.

Other possible reasons to execute an MBO include to take a public company private or to function as a succession plan for an owner-operator company. Executing an MBO makes it possible to stabilize management by preventing the dilution of shares when the management team takes over the company from its current owner.

DBJ, as a financial advisor, addresses the diverse needs of its clients, including bringing together the MBO overall, financing arrangements, providing mezzanine financing, and making equity investment with a joint sponsor.

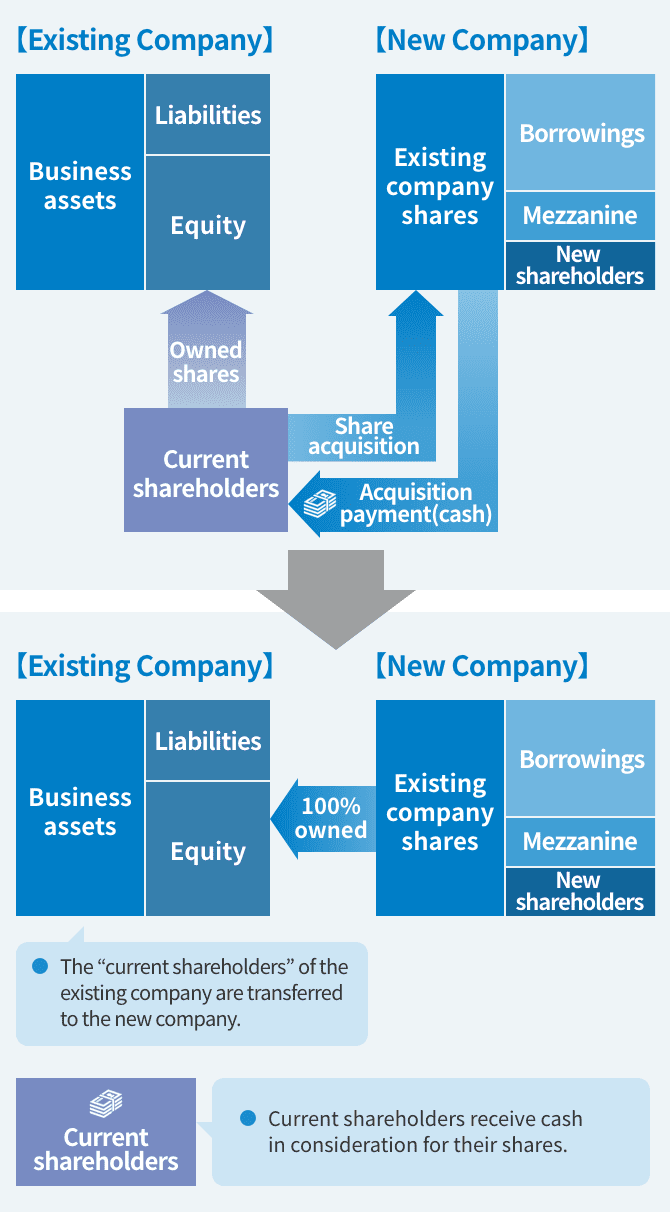

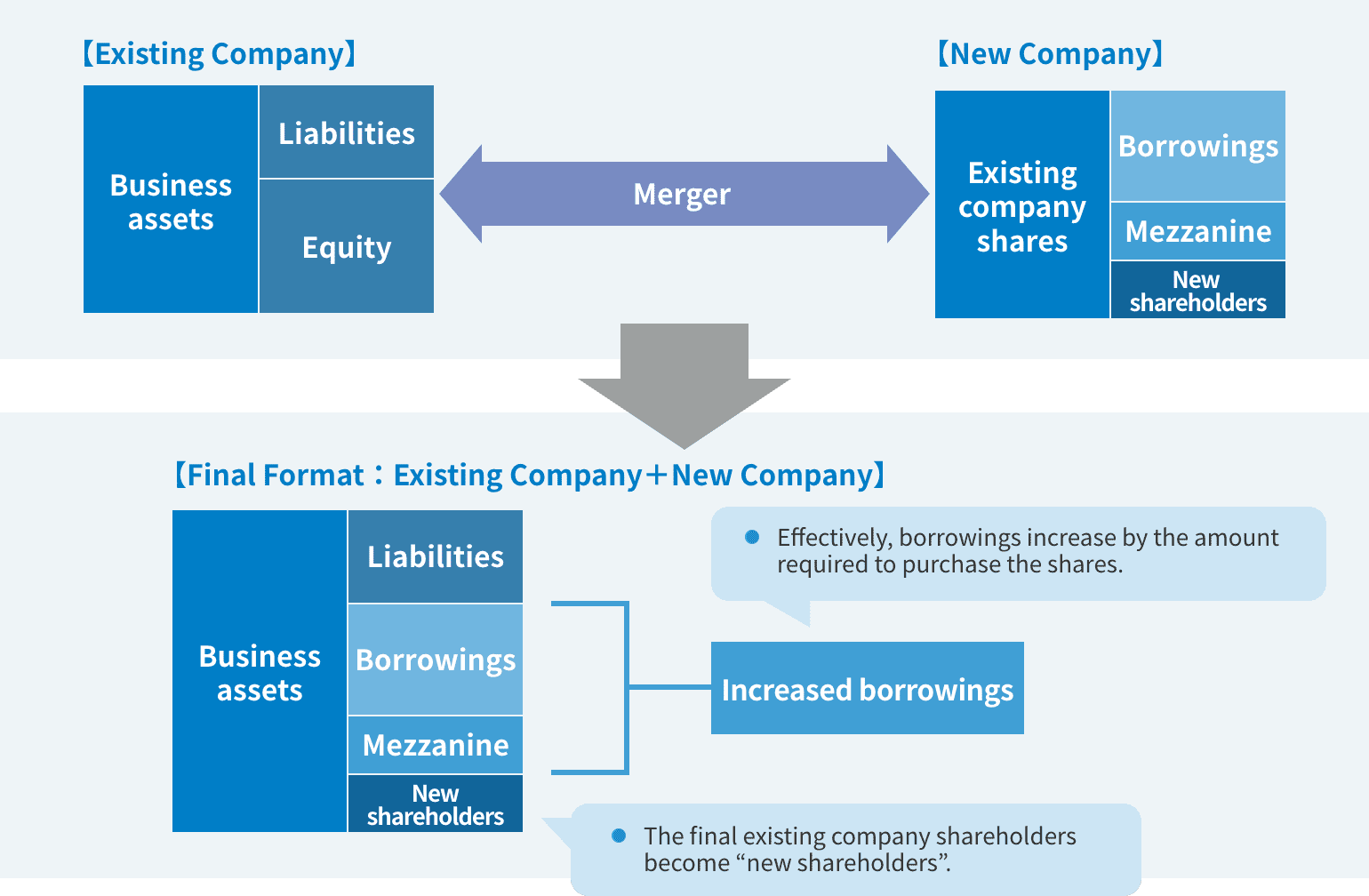

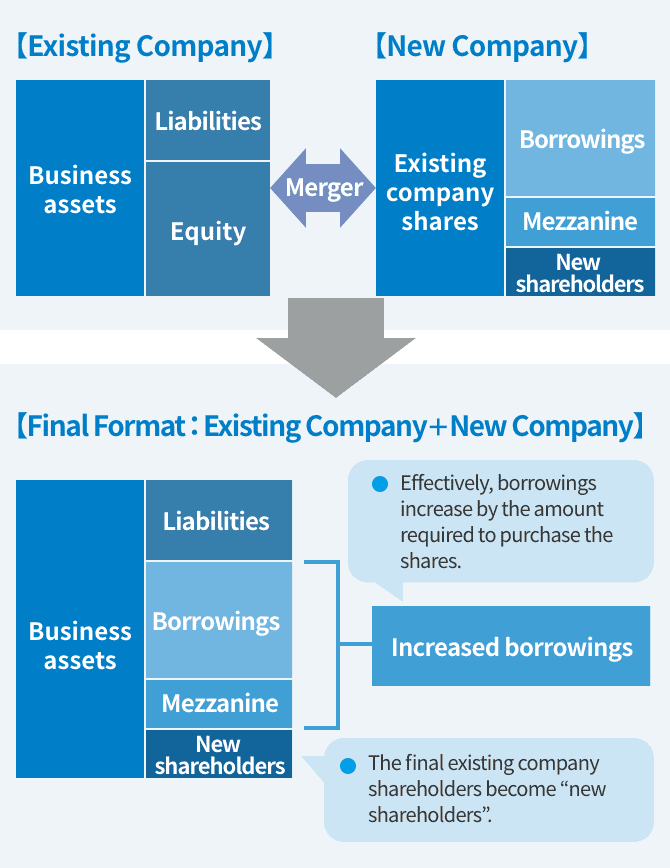

Scheme(MBO)

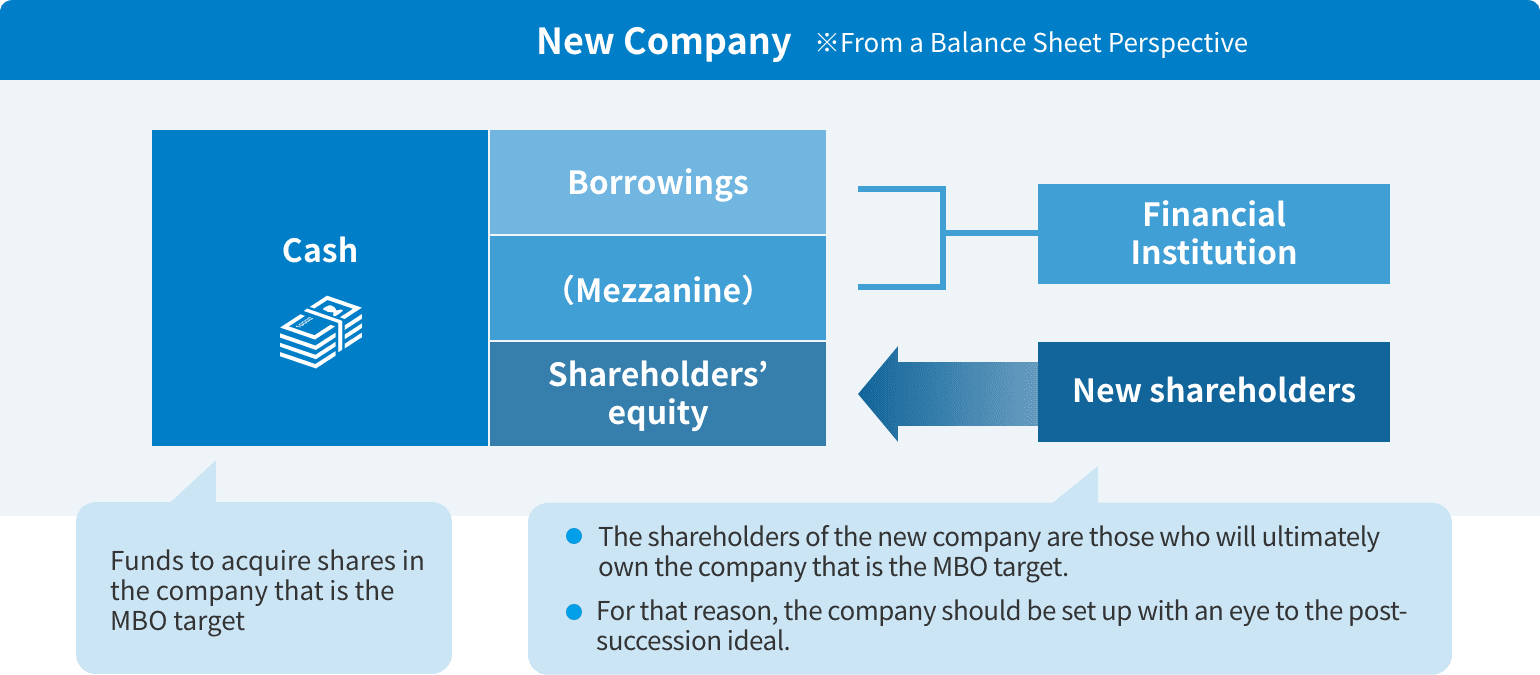

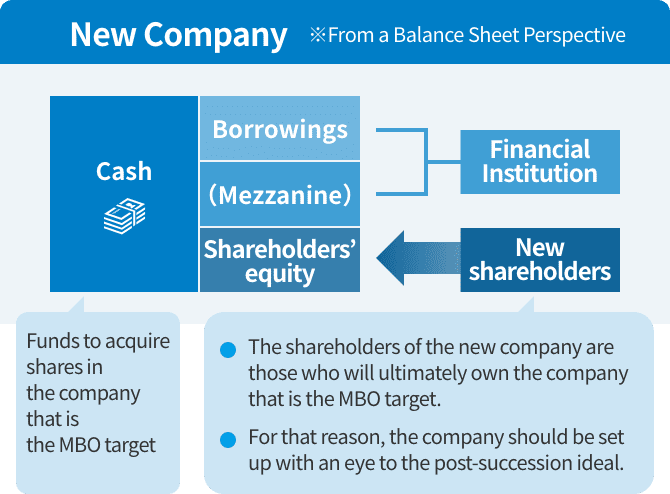

First Step

Establish new company to serve as the conduit for share acquisition.

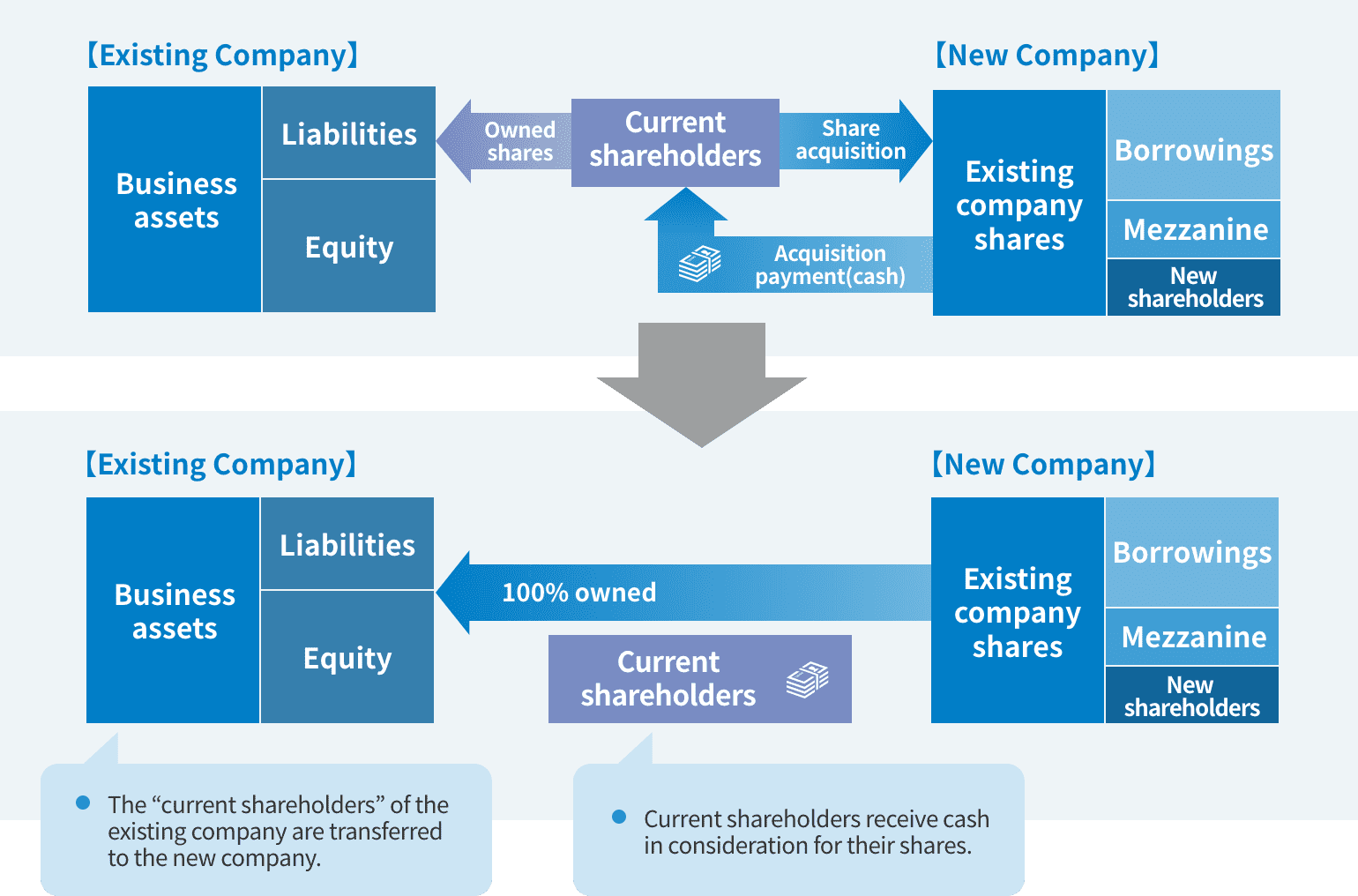

Second Step

The new company accumulates shares from existing shareholders.

Third Step

Your company merges with the new parent company.

Related information

- Service

- Medium- to Long-Term Loans

- Structured Finance

- Asset Financing (Real Estate)

- Syndicated Loans

- Asset-Based Lending (ABL)

- Debtor-in-Possession Financing

- Crisis Response Operations

- Mezzanine Financing

- LBOs / MBOs

- Equity

- Collaborative Fund Operations

- Special Investment Operations

- DBJ Sustainable Solutions(Open in new window)

- DBJ Certification Programs

- DBJ Sustainability Linked Loans with Engagement Dialogue

- DBJ Green Building Certification

- The DBJ Visionary Hospital Program

- Regional Emergency Response Program

- M&A Advisory Services

- Support for Startups

- Support for Innovation

- Public Asset Management

- Asset Management