The Development Bank of Japan Inc. Act (New DBJ Act)

The Establishment of the Development Bank of Japan Inc.

(Enactment of the New DBJ Act at the 166th Regular Diet Upper House Plenary Session)

Excerpt from the New DBJ Act (Act No. 85 of 2007)

The Development Bank of Japan Inc. Act (New DBJ Act)The Establishment of the Development Bank of Japan Inc.(Enactment of the New DBJ Act at the 166th Regular Diet Upper House Plenary Session)

The Development Bank of Japan Inc. Act (New DBJ Act) (Japanese text only)

Summary of Changes to the DBJ Act after Conversion to a Joint-Stock Company

Trends involving DBJ following its privatization (incorporation)

On October 1, 2008, DBJ transitioned from a special public corporation to a joint-stock company. In preparation for full-scale privatization following the disposal of all Japanese government-owned shares, DBJ has continued working to enhance its corporate value through integrated investment and loan services. These activities include providing long-term loans; equity, mezzanine financing,and other types of risk capital; and M&A advisory services.

On the other hand, shortly after DBJ’s conversion to a jointstock company, the global financial crisis and the Great East Japan Earthquake occurred. The Japanese government called on DBJ to steadily mount large-scale Crisis Response Operations. Due to these crises, the Development Bank of Japan Inc. Act (Act No. 85 of 2007: “DBJ Act”) was amended twice, with DBJ accepting an additional increase in Japanese government capital. Also, by the end of fiscal 2014, the Japanese government was to review DBJ’s organization, including its shareholdings, as stipulated by the revision.

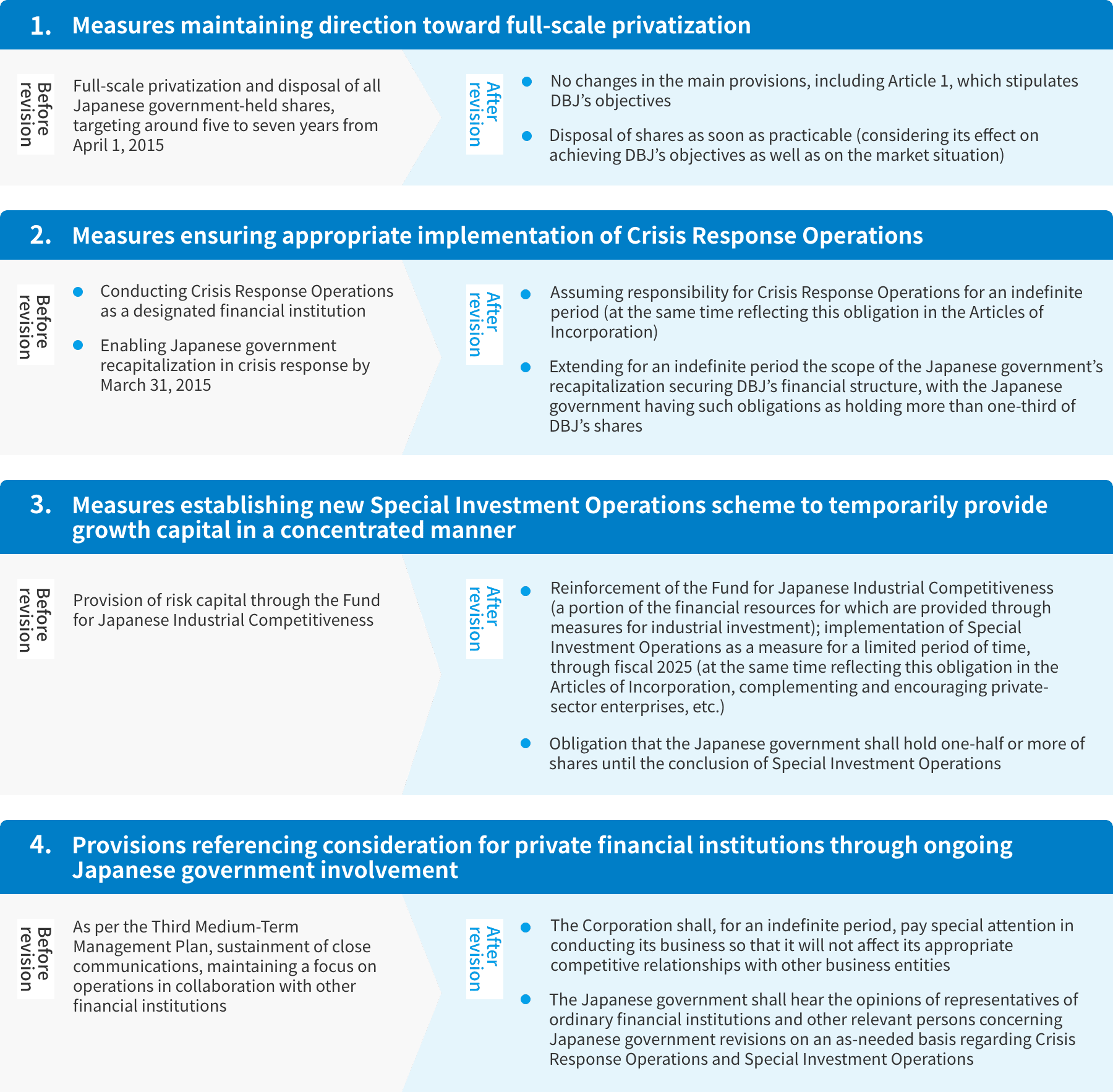

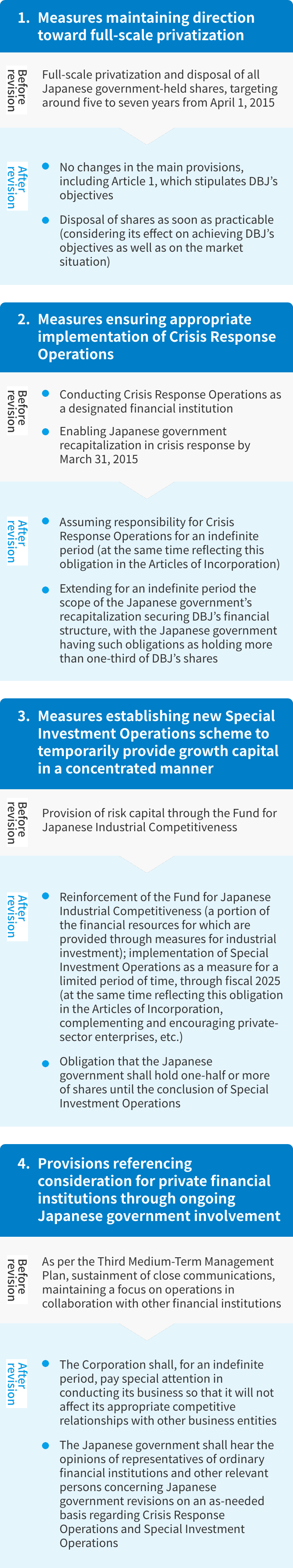

Based on the deliberations by the Japanese government's Study Panel Concerning the Promotion of Expanding Growth Funding, the Act for Partial Amendment of the Development Bank of Japan Inc. Act(Law No. 23 of 2015), which was enacted on May 20, 2015, maintains the direction toward full-scale privatization. At the same time, in order to fully ensure the provision of funding in response to large-scale disasters and economic crises, the amended act makes DBJ’s Crisis Response Operations obligatory for an indefinite period. From the perspective of promoting the provision of growth capital to revitalize regional economies and increase the competitiveness of enterprises, the amended act calls for DBJ to accept a certain amount of capital from the Japanese government (industrial investment). This investment is to be used for a new scheme, Special Investment Operations, to strengthen and develop the Fund for Japanese Industrial Competitiveness. In addition, with regard to the application of DBJ’s investment and loan functions toward crisis response and the provision of growth capital, measures were introduced obliging the Japanese government to hold at least a certain percentage of DBJ’s shares.

As part of this structural revision, deliberations by the Japanese government's Study Panel Concerning the Promotion of Expanding Growth Funding covered such topics as DBJ's proper implementation of Crisis Response Operations, the importance of initiatives for providing growth capital (equity and mezzanine financing) to address shortages in Japanese financial and capital markets, and an evaluation of DBJ's initiatives following its conversion to a joint-stock company.

Highlights of 2015 Revisions to the DBJ Act

Based on discussions held in 2019 by the government’s Investigative Committee on Special Investment Operations of the Development Bank of Japan, Inc., the Act to Amend the Development Bank of Japan, Inc. Act (Law No. 29 of 2020) enforced on May 5, 2020, requires that the following measures be taken in regard to special investment operations.

- (1)

Extension of deadlines for investment decisions and government investment from March 31, 2021, to March 31, 2026

- (2)

Extension of deadline for conclusion of work from March 31, 2026, to March 31, 2031

Based on discussions held in 2024 by the government’s Investigative Committee on Special Investment Operations of the Development Bank of Japan, Inc., the Act to Amend the Development Bank of Japan, Inc. Act (Law No. 36 of 2025) enforced on May 16, 2025, requires that the following measures be taken in regard to special investment operations.

- (1)

Extension of deadlines for investment decisions and government investment from March 31, 2026, to March 31, 2031

- (2)

Extension of deadline for conclusion of work from March 31, 2031, to March 31, 2041