Risk Management

Risk Management System

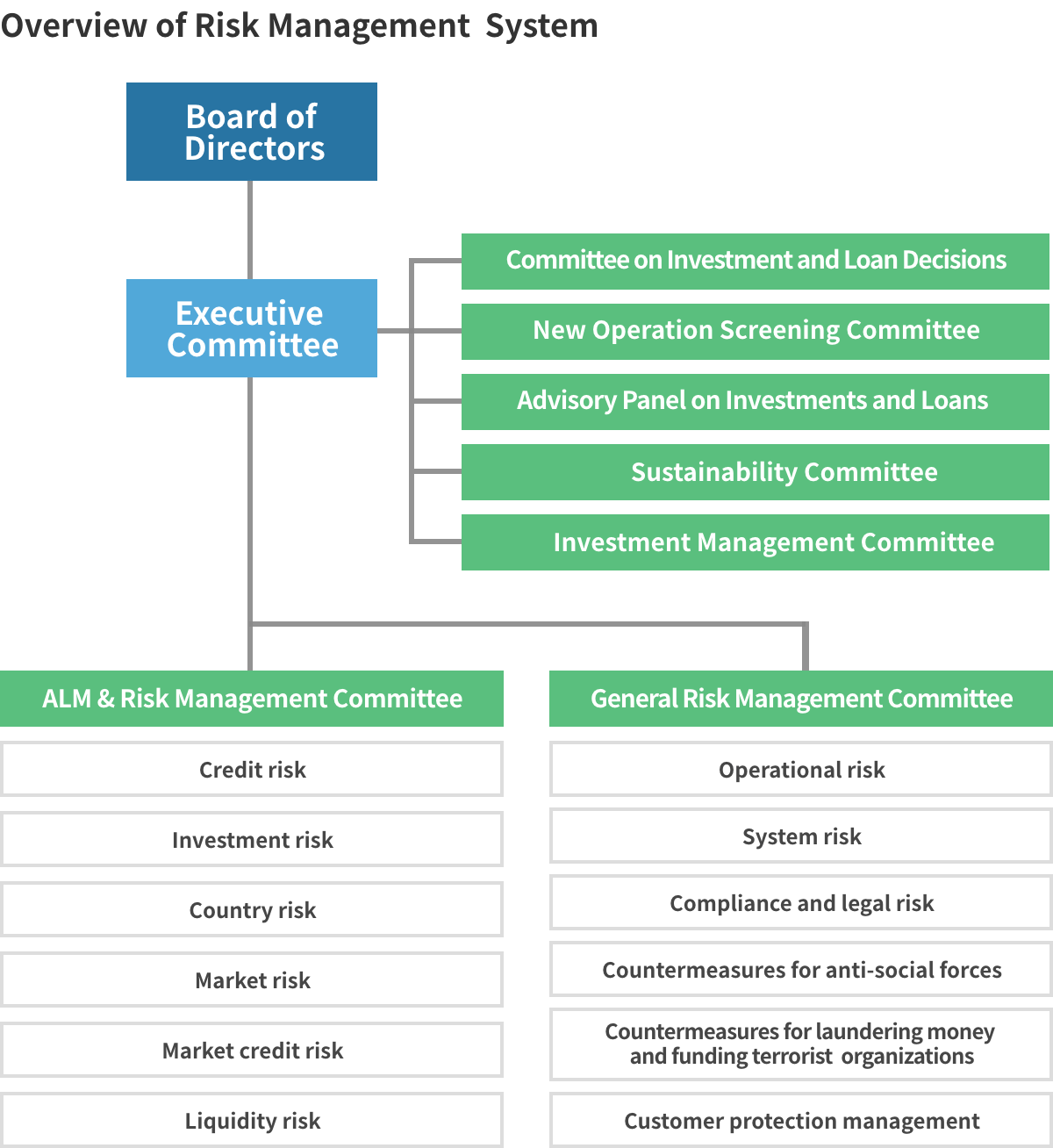

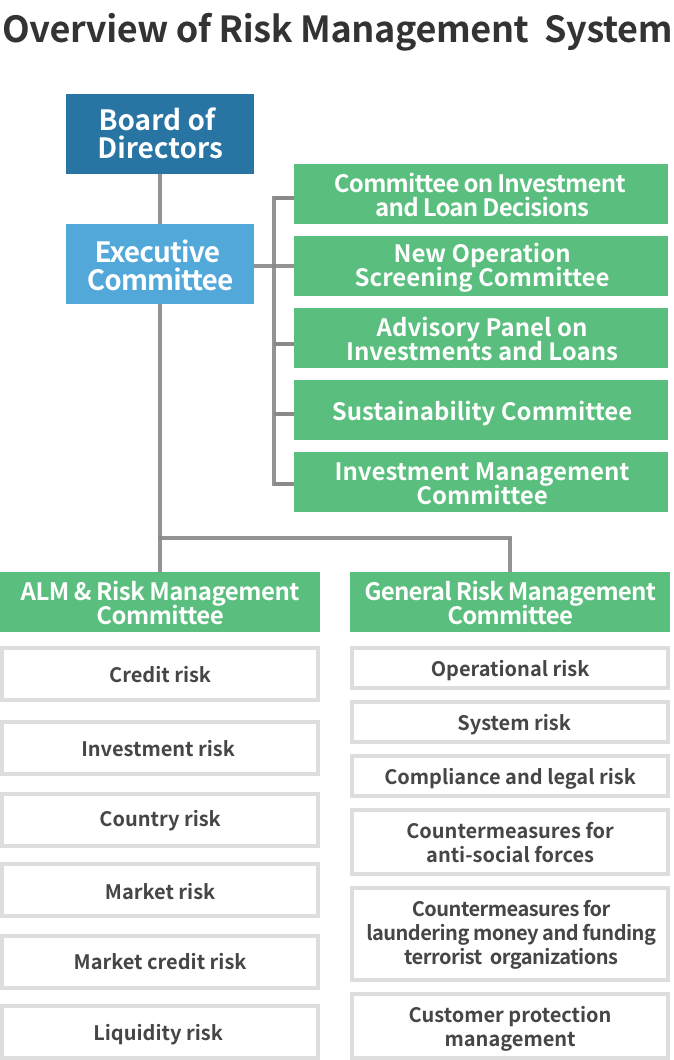

DBJ has a risk management system in place designed to handle a variety of specific risks, with the aim of maintaining the soundness and creditability of management as it pursues business based on management plans. Specifically, risks are identified, evaluated, monitored, and controlled in each risk category and in comprehensive risk areas, and are managed within the scope of our management capabilities from a comprehensive understanding of each risk.

The Board of Directors sets out basic policies for comprehensive risk management, receives reports about risk management conditions, and ensures the effectiveness of risk management functions. The Executive Committee creates related rules based on these basic policies and deliberates on matters of importance that directly relate to management policies. In line with these basic policies and rules, the ALM & Risk Management Committee discusses and makes decisions on matters essential to the risk management system for financial risk, such as credit risk, while the General Risk Management Committee deliberates on non-financial risk, such as administrative risk. Both committees meet regularly, and whenever necessary, conduct risk monitoring.

Comprehensive Risk Management

We measure the amount of each type of risk using uniform and logical methodologies to the greatest extent possible, while considering the uniqueness of each risk category. As the sum total of this risk, comprehensive risk is managed within the context of our risk guidelines. These risk guidelines are determined by the Executive Committee and reflect risk conditions in the existing portfolio and latest business plans, within the framework for capital allocation based on the amount of our own capital.

Credit Risk

Credit risk refers to the risk of sustaining losses resulting from a decline in or loss of the value of assets due to deterioration in the financial condition of the borrower. DBJ provides corporate loans and non-recourse loans, making credit risk acquisition a source of profits. As such, it represents a significant risk category, and DBJ conducts credit management of individual projects as well as Bank-wide portfolio management accordingly.

Credit Administration of Individual Loans

When making an investment or loan, DBJ examines the entity’s project viability and the project’s profitability from a fair and impartial standpoint. Based on the Banking Act and the Act on Emergency Measures for the Revitalization of Financial Functions (Act No. 132 of 1998), DBJ carries out independent asset assessments in an effort to properly grasp credit risk in a timely fashion. The results of self-assessments are subject to an audit by an auditing corporation and are reported to management.

The sales and credit analysis departments hold separate roles in the screening and administering of credit for individual projects, and each department keeps the operations of the other in check.

The Committee on Investment and Loan Decisions meets as needed to deliberate important issues concerning the management and operation of individual projects.

These mutual checking functions serve to ensure the appropriateness of the finance operation and management system.

Borrower Rating System

DBJ’s borrower rating system measures creditworthiness by combining an evaluation point rating and a borrower category rating, with the results quantifying a potential client’s credit circumstances.

The evaluation point rating selects indicator and evaluation categories that are common across all industries, scoring the creditworthiness of the potential borrower quantitatively and qualitatively. On the other hand, the borrower category rating measures specific items related to the borrower, looking at the borrower’s realistic financial condition, cash flows, and debt repayment history, generating a comprehensive assessment of a borrower’s repayment capacity.

Asset Self-Assessment System

Asset self-assessments are used to define asset classifications that will offset recoverability risk or the degree of risk of value loss based on the borrower rating, the corresponding borrower category, and the collateral or guarantee status. Such assessments help DBJ establish timely and appropriate amortization schedules and reserve levels.

Borrower Rating Classifications

| Borrower category | Borrower rating | Definition | Claims classified under the Financial Revitalization Act |

|---|---|---|---|

| Normal borrowers | 1–8 | Borrowers with favorable business conditions who have been confirmed to have no particular problematic financial circumstances. | Normal claims |

| Borrowers requiring caution | 9–11 | Borrowers in this category are experiencing weak or unstable business conditions, or are having issues with their finances. These borrowers need to be managed with caution. | |

| Substandard borrowers | 12 | Either some or all of the debt of these borrowers requiring caution is under management. | Substandard claims |

| Borrowers in danger of bankruptcy | 13 | Borrowers in this category are having financial difficulties but are not bankrupt. Management improvement plans and the like are progressing poorly, and these borrowers are highly likely to fall into bankruptcy. | Doubtful claims |

| Effectively bankrupt borrowers | 14 | Although not legally or formally in bankruptcy, these borrowers are experiencing severe financial difficulties and are realistically falling into bankruptcy as their lack of potential for restructuring has been confirmed. | Claims in bankruptcy, reorganization claims, and similar claims |

| Bankrupt borrowers | 15 | These borrowers are in bankruptcy, legally and formally. Specifically, these borrowers are in bankruptcy or liquidation, under corporate reorganization, bankruptcy proceedings or civil rehabilitation, or have had transactions suspended by a bill clearinghouse. |

Portfolio Management

DBJ performs a statistical analysis of data based on borrower

ratings and calculates the loan portfolio’s overall exposure to

credit risk. Credit risk exposure is classified as unexpected loss

(UL), the maximum loss that could be incurred at a certain rate

of probability minus the expected loss (EL), the average loss

expected during a specific loan period.

Large borrowers are identified based on standardized loan

balances defined by the borrower’s rating and monitored as

required in accordance with management policies.

Investment Risk

Investment risk refers to the risk of sustaining losses resulting from a decline in or loss of the economic value of assets due to worsening financial conditions for entities receiving funds and to changing market environments. DBJ’s investments include the provision of mezzanine and equity financing, particularly to unlisted entities, such as corporations, funds, infrastructure, and real estate. As a source of profits, investments represent one of DBJ’s most significant risk categories, as with credit risk. DBJ makes investment decisions and manages individual investments as well as its Bank-wide portfolio accordingly.

| Type | Major risks | Returns |

|---|---|---|

| Corporate mezzanine financing | Credit risk, etc. | Dividends, etc. |

| Corporate investment (including listed shares) |

Business risk Market risk |

Capital gains |

| Real estate and infrastructure, etc. | Risk of change in asset value Operating risk at operating entities |

Income gains |

Investment Policy

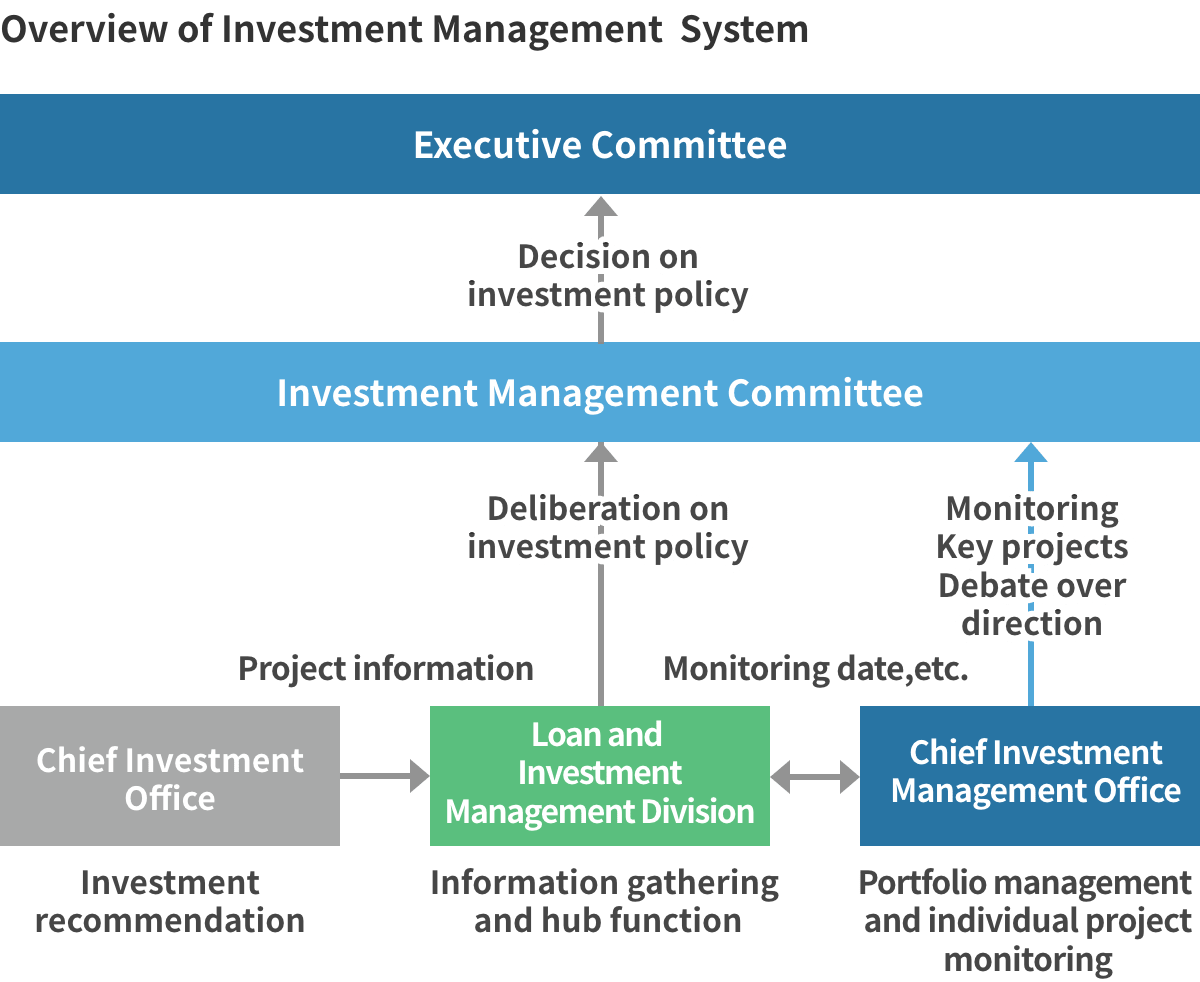

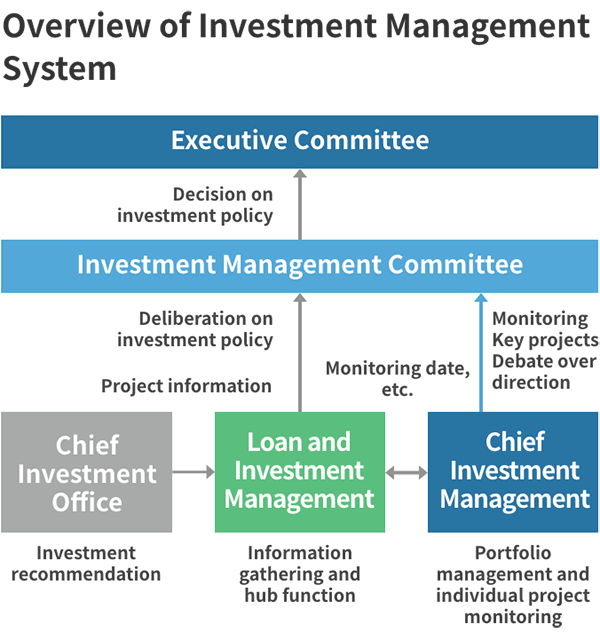

The Executive Committee determines our investment policy following deliberations each fiscal year by the Investment Management Committee, based on our corporate philosophy of striking a balance between social value and economic value.

This policy takes into consideration the balance in risks and returns in the overall portfolio, while also reflecting the external business environment, including changes in market conditions and industrial structure, and a performance analysis of the existing portfolio.

Credit Management of Individual Projects

Investment decisions for individual projects are made after exit strategies are determined in case a downside scenario materializes, and targets are set for returns based on the type of investment, which is also examined in order to manage credit risk.

In project management, DBJ periodically monitors every project and has established the Chief Investment Management Office to enhance monitoring of key projects and improve the management of investment risks in the overall portfolio.

Portfolio Management

The bulk of assets in our investment portfolio consists of unlisted shares and mezzanine loans. We quantify our risk exposure to these assets with a focus on risk characteristics in each asset category and differences in methods for recouping investments.

Specifically, DBJ assesses credit risk based on asset type with the aim of recovering the investment, mainly through business cash flow. We also take into account market risk for asset types where investments are likely to be recovered when the asset is sold to a third party or the market. In these ways, DBJ quantifies risks by applying methods to estimate credit risk and market risk.

Market Risk

DBJ classifies market risk as risk pertaining to investment and loan activities. The main risks it manages are interest rate risk and foreign exchange risk. DBJ does not have any trading-related risk (specified transactions).

Interest Rate Risk

Interest rate fluctuations can create mismatches on rates of interest on assets and liabilities or on interest periods, creating the risk of reduced profits or the risk of losses. Interest rate risk can reduce the economic value of DBJ’s assets or interest income.

Based on monitoring through multifaceted indices, such as value at risk (VaR) and interest rate sensitivity analyses (duration and basis point value), as well as ALM policies established by the ALM & Risk Management Committee, DBJ conducts comprehensive management of current assets and liabilities to optimize net interest expenses and economic value by adequately controlling interest rate risk.

Foreign Exchange Risk

Foreign Exchange risk is the risk of loss due to volatility in exchange rates, and this risk affects entities holding a net excess of assets or liabilities denominated in foreign currencies.

Foreign Exchange risk derives from financing in foreign currencies and issuing foreign currency bonds. However, DBJ uses Foreign exchange swaps and other instruments to limit this risk.

Market Credit Risk

DBJ aims to reduce counterparty risk in derivatives transactions through margin transfers by means of a centralized exchange and mutual credit support annex. Financial institution transactions are managed within the limits of the creditworthiness of the counterparty. Transactions with operating companies and other customers are managed within the framework of comprehensive risk management for fluctuation risks, and measurements of credit valuation adjustment (CVA) are based on accounting standards.

Liquidity Risk

Liquidity risk is the risk of a mismatch occurring in the periods when funds are used and raised or of an unexpected outflow of funds, causing differences in the flow of funds (cash liquidity risk). Such situations make securing funds difficult and create situations in which interest rates on borrowed funds are substantially higher than usual rates. At other times, because of market complexities, entities in these circumstances may become unable to participate in market transactions, compelling them to conduct transactions under substantially less favorable terms than otherwise would be the case. The risk of losses for these reasons is known as market liquidity risk.

As its main methods of acquiring funds, rather than carrying out short-term funding by issuing commercial paper, DBJ relies on the stable procurement of long-term funds from the Japanese government’s Fiscal Investment and Loan Program and government-guaranteed bonds while issuing bonds and taking out long-term loans. To prepare for unforeseen cash flow crunches caused by shocks to financial markets, DBJ manages funds to ensure sufficient cash on hand to cover planned capital outflows under envisioned stress conditions. DBJ has formulated countermeasures based on contingency plans in the event they become necessary depending on the mode classification, and it has created different categories for fund operation modes based on the degree of constriction in cash flows.

Operational Risk

DBJ defines operational risk as the risk of loss arising from internal processes, people, or systems that are inappropriate or nonfunctioning, or from external events. DBJ works to establish a risk management system to minimize risk and prevent potential risk from materializing. The General Risk Management Committee has been established to deliberate topics concerning operational risk management.

Within operational risk management, DBJ conducts administrative risk management and system risk management as described below.

Administrative Risk Management

Administrative risk refers to the risk of sustaining losses resulting from employees neglecting to perform their duties correctly or from accidents, fraud, and so on. To reduce or prevent administrative risk, DBJ prepares manuals, performs checks on administrative procedures, provides education and training, and uses systems to reduce the burden of administrative duties.

System Risk Management

System risk refers to the risk of loss due to a computer system breakdown or malfunction, system defects, or improper computer use. DBJ has implemented the following internal processes to optimize system risk management and properly manage risk with regard to system risk. The System Risk Management Division is responsible for managing DBJ’s system risk centrally, based on its system risk management regulations. By determining security standards from a variety of viewpoints—from information system planning and development to operation and use—the department extends the risk management system Bank-wide and addresses appropriate system risk management operations.

Over the past few years, cyberattacks have rapidly become more advanced and cunning, and the DBJ Group is aware of the increasing risk of being damaged by a cyberattack. Given these circumstances, the Group has set up the Cyber Security Office and the DBJ Computer Security Incident Response Team (DBJ-CSIRT) as a team dedicated to responding to cybersecurity incidents across related divisions, centered on the Cyber Security Office and the Corporate Planning & Coordination Department. DBJ-CSIRT is in charge of responding to cybersecurity incidents within the DBJ Group as well as maintaining and updating the necessary response systems.

Stress Tests

In addition to managing comprehensive risks based on risk exposure, DBJ performs stress tests on its own capital adequacy in order to ensure uninterrupted financial functions, including Crisis Response Operations, while maintaining the soundness of management under stressful conditions. These stress tests are also used in evaluating the degree of impact on our own capital from the creation of and changes to medium-term management plans and business plans, as well as in examining possible responses to various management issues.

Based on the latest forecasts for economic conditions and in light of the international situation, these stress tests take into account DBJ’s financial position in various scenarios for challenging conditions, such as a major economic recession or strong market stressors. We evaluate whether financial functions can be smoothly executed and adequate financial health maintained under stressful conditions, by factoring in various scenarios for how risk exposure and risk-weighted assets increase as a result of erosion of our own capital, and of changes in our portfolio of loans and investments.

We also verify the adequacy of our cash liquidity.

Business Continuity Initiatives

DBJ has prepared a business continuity plan (BCP) to protect the interests of its stakeholders, including its clients, its shareholders, and its executives and employees, as well as to fulfill its social mission. The BCP aims to ensure the continuity and rapid recovery of core operations in the event of emergencies, such as natural disasters (in particular, large-scale earthquakes), influenza and other pandemics, system failures, and power outages.

The BCP describes in an easy-to-understand format the role of the Disaster Response Committee, work priorities, and specific actions and procedures to be taken in the event of a disaster. When drawing up policies for business continuity and restoration, the Company envisions specific incidents, such as an earthquake underneath the Tokyo metropolis or a novel virus outbreak, and methodically decides how to respond to anticipated damage in each disaster scenario.

Measures to Ensure Business Continuity

We have prepared a variety of measures to ensure business continuity.

Enhanced System Robustness

We have ensured advanced security levels at the main center and created a backup center to operate in the event that the main center ceases to operate.

Multilayered Communication Procedures

We have introduced a safety confirmation system to quickly determine the whereabouts and status of executives and employees even at night and on holidays. In addition, we have distributed satellite telephones to key locations and personnel to ensure multilayered communication procedures.

Chain of Command and Delegation of Authority

To assure that decision-making concerning the continuity of core operations is prompt and certain in the event that it becomes necessary to execute the plans of the Disaster Response Committee, we have put in place a chain of command and an alternative hierarchy by which authority can be delegated.

Clarification of Initial Response and Procedures for Continuing or Recovering Core Operations

For individual business units, we have established in advance the procedures for the initial response and the continuation or recovery of core operations so that relevant divisions can respond quickly and with certainty on core operations even when in a state of confusion.

Initiatives to Maintain or Improve BCP Viability

DBJ conducts various types of instruction and training of executives and employees to maintain or improve the viability of its BCP. Furthermore, employing a plan–do–check–act cycle, we revise the BCP to reflect training results and recent information, and the Executive Committee reviews it regularly and amends it as necessary.

Response to the TCFD Recommendations

This section describes DBJ's Response to the TCFD Recommendations.

- Sustainability

- Sustainability News

- Message from the President

- Sustainability Management System

- Policy on Sustainability

- DBJ Group Human Rights Policy

- Value Creation Process

- Priority Areas for the Achievement of Vision 2030

- Resolving Social Issues and Creating Value Through Our Core Businesses

- Fundamental Activities

- Collaboration with Stakeholders