Response to the TCFD Recommendations

Basic Approach

Since the adoption of the Paris Agreement in 2015, governments, industrial groups and companies around the world have declared commitments to move towards a decarbonized society, and activities are gaining momentum to mitigate and adapt to climate change. In October 2020, the Japanese government declared a goal of carbon neutrality by 2050, and various government policies are advancing the achievement of net zero greenhouse gas (GHG) emissions.

In May 2017, the DBJ Group set out its Policy on Sustainability to represent its basic approach to contributing to the realization of a sustainable society that balances economic value with social value. Based on this policy, the DBJ Group contributes to the realization of decarbonized society by solving issues faced by regions and its customers while collaborating with stakeholders. The DBJ Group has positioned addressing climate change, a problem affecting the entire world, as a priority of the utmost importance on the path to creating a sustainable society while also ensuring a stable supply of energy.

Under the Fifth Medium-Term Management Plan, which commenced in fiscal 2021, the DBJ Group is advancing its GRIT Strategy* with the aim of building an industrial foundation as well as flexible, strong, safe, and secure regions and communities in a green society. At the same time, through dialogue (engagement) with customers, the DBJ Group supports their efforts in the transition to decarbonized society.

The DBJ Group intends to pursue net zero GHG emissions for its investment and loan portfolio by 2050 while solving management issues and assisting its customers’ efforts to decarbonize. Through this process, we are helping Japan maintain and strengthen its competitiveness and spurring growth in our customers’ businesses.

* GRIT: Green, Resilience & Recovery, Innovation, and Transition / Transformation

Governance

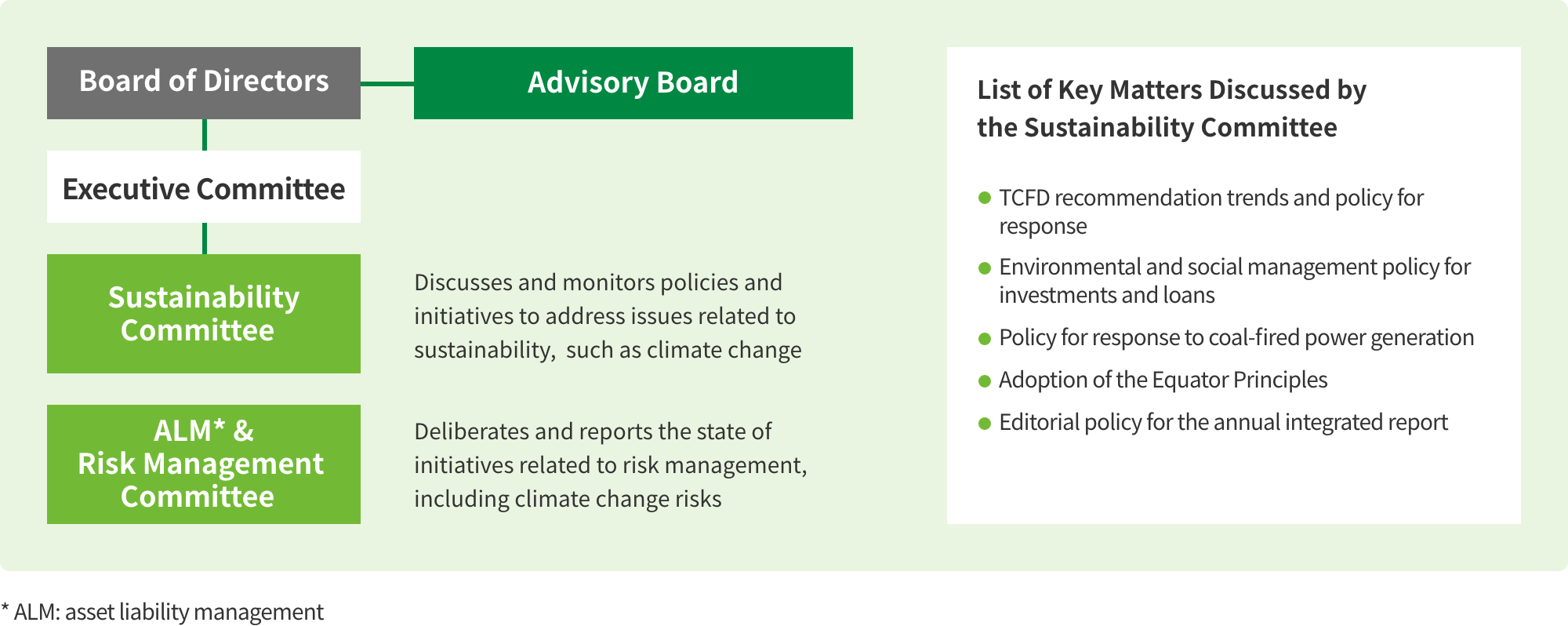

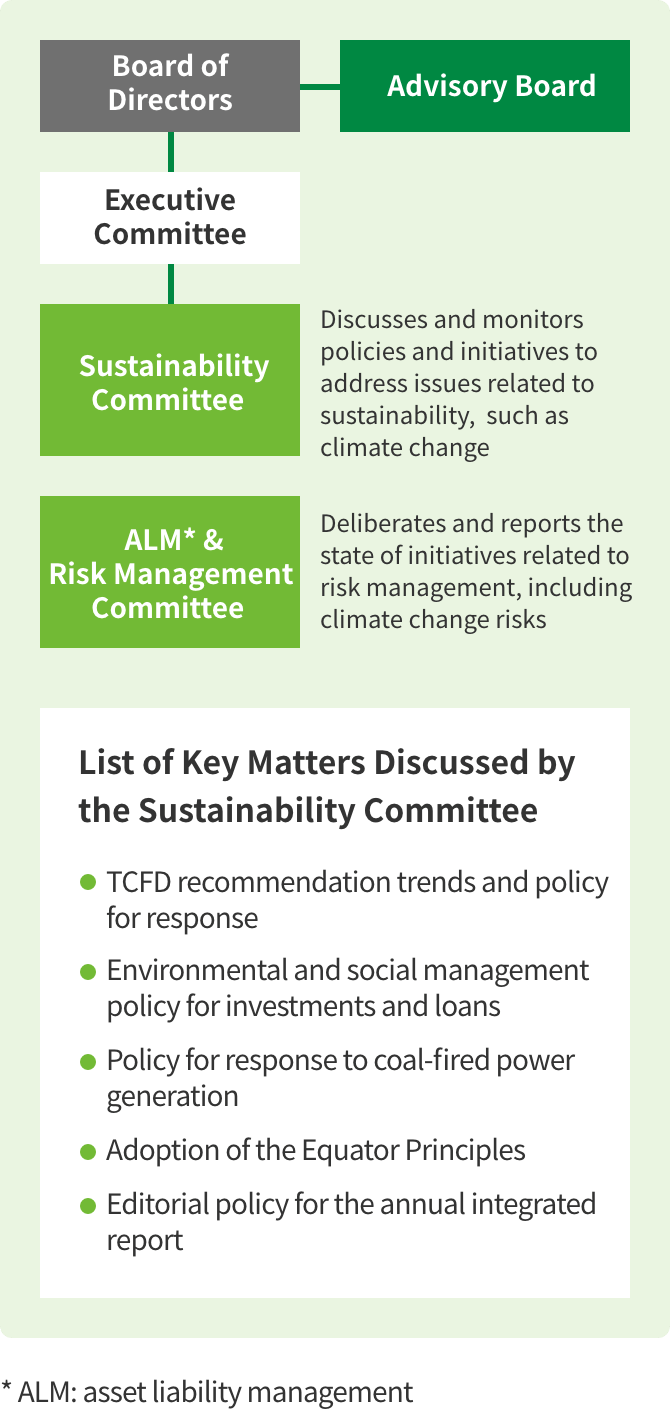

Under the Executive Committee, the Sustainability Committee deliberates on policy responses to various sustainability-related issues, such as climate change, and monitors progress on corresponding initiatives. With regard to the content of stakeholder communications and important initiatives in management strategy, the Sustainability Committee deliberates and reports these matters to the Board of Directors after the Executive Committee reviews and decides such matters. The Sustainability Management Office has been created as an administrative body within the Corporate Planning & Coordination Department to advance various measures and act as a hub for information inside and outside the DBJ Group.

The Advisory Board, an advisory body to the Board of Directors consisting of outside experts and outside directors, reports on the progress of initiatives, such as the GRIT Strategy and other business plans, and the content of its deliberations is reflected in business plans and measures to enhance risk management.

Organizational Chart

Strategy

Basic Approach to Climate-Related Risks and Opportunities

When formulating its Vision 2030, the DBJ Group identified climate change, natural resources, and energy as areas of change in the external environment that are having a major impact on the stakeholders of the DBJ Group. Properly understanding the risks and opportunities related to climate change is essential when establishing business strategies. The DBJ Group intends to pursue net zero GHG emissions for its investment and loan portfolio by 2050. Based on a scenario where the world moves toward decarbonized society (with an average rise in global temperatures below 2.0°C), we are advancing initiatives that take into account the results of our analysis of risks and opportunities, including those in scenarios where average temperatures increase more than 2.0°C.

Analysis of Climate-Related Opportunities

In fiscal 2019, DBJ began to analyze scenarios for 2030–2050 from medium- and long-term standpoints. In light of future uncertainties associated with climate change, financial institutions must envision a variety of scenarios for the economy and society in the future, and consider changes in their portfolios and countermeasures based on these scenarios. As an initial approach, we utilized Shared Socioeconomic Pathways (SSPs), which are GHG emissions scenarios under various climate policies, to analyze and assess the impact on businesses. Our focus was on transition opportunities in the context of government policies and regulations and technological innovation for attaining low-carbon or zero-carbon society in the framework of four visions for the world in the future.

Summary of Analysis

| Sectors covered | Energy, transportation, urban development |

|---|---|

| Scenario | Use SSP scenarios to analyze scenarios where the average temperature increases by 1.5°C, 2°C, and 4°C |

| Relevant technologies | Carbon capture and storage, electric vehicles, biomass, hydrogen, renewable energy |

| Period covered | 2030–2050 |

Analysis of Climate-Related Risks

The DBJ Group is aware of climate-related financial risks in terms of transition risks and physical risks. Transition risks could impact the business strategy of the DBJ Group by increasing credit costs if the creditworthiness of the recipients of its investments and loans declines due to lower sales and higher costs, mainly from the introduction of a carbon tax and upgrades to low-carbon technologies. Physical costs might also impact our business strategy by increasing credit costs if the creditworthiness of the recipients of our investments and loans declines due to damages to collateral value as a result of abnormal weather or supply chain disruptions.

In fiscal 2021, DBJ analyzed scenarios for the electric power sector, including structured finance projects for energy projects in Japan and around the world (for transition risks), and damage to collateral value due to water disaster (for physical risks). The results of this analysis indicate that even if DBJ’s current portfolio balance were to stay the same, the financial impact would be limited to an acceptable level from a long-term perspective.

The DBJ Group is aware that the methodologies and data used to analyze financial risks related to climate change continue to evolve. While monitoring trends in this field, we will adopt more advanced methods of analysis if necessary.

Summary of Analysis

| Transition risk | Physical risk | |

|---|---|---|

| Risk event | Sudden change in policy toward net zero GHG emissions | Water damage (flooding) |

| Scenario | NGFS*1 Delayed Transition scenario | IPCC*2 RCP*3 8.5 (4ºC scenario) |

| Present analysis targets | Electric power sector | Damage to collateral value as a result of flooding |

| Assets covered | Balance of investments and loans | Balance of loans |

| Analysis period | By 2050 | By 2050 |

| Analysis results (level of increase in credit costs) | About ¥40.0 billion (cumulative) | About ¥6.0 billion (cumulative) |

*1 NGFS: Network for Greening the Financial System

*2 IPCC: Intergovernmental Panel on Climate Change

*3 RCP: Representative Concentration Pathway

Strategy Based on Analysis of Climate-Related Risks and Opportunities

In addition to analyzing climate-related risks and opportunities, The DBJ Group is advancing green, transition, and innovation initiatives through its GRIT Strategy, and intends to make investments and loans totaling ¥5.5 trillion over the five years of the strategy.

Under this policy, the Group is providing sustainable financing and consulting and advisory services to support the initiatives of its customers to decarbonize. The DBJ Group is also supplying risk capital to climate technology firms.

Constructive Dialogue (Engagement) with Customers

Through constructive dialogue (engagement) with customers, we enhance mutual understanding of management issues and awareness of problems, deepen our understanding of each customer’s needs and issues, and propose solutions. In this way, we offer support through investments and loans and consulting and advisory services backed by the strengths of the entire DBJ Group.

Example (1) Kawasaki Heavy Industries, Ltd.

A hydrogen supply chain is an essential part of sustainable growth and Japan’s efforts to become carbon neutral. In consultation with DBJ, Kawasaki Heavy Industries, Ltd. set key performance indicators and sustainability performance targets (SPTs) for its extensive Hydrogen Road initiatives linking hydrogen production sites with energy consumers. DBJ Group then extended DBJ Sustainability Linked Loans with Engagement Dialogue to the company.

During the loan period, we will support the company through periodic dialogue as it strives to achieve its SPTs.

Example (2) Mitsui O.S.K. Lines

Ferry Sunflower Limited, a subsidiary of Mitsui O.S.K. Lines, plans to operate the first two ferries fueled by liquefied natural gas (LNG) in Japan. These LNGfueled ferries were selected as a Climate Transition Finance Model Project by the Ministry of Economy, Trade and Industry, and the DBJ Group extended a syndicated transition loan for this project.

This syndicated loan was put together with Sumitomo Mitsui Trust Bank, Limited and regional financial institutions.

Example (3) Shikokuchuo City Carbon Neutrality Council

As a part of their efforts to foster carbon neutrality, Ehime Paper Co., Ltd., Daio Paper Corporation, and Marusumi Paper Co., Ltd. established this council to evaluate energy conversion throughout the Shikokuchuo area.

As it examines the possibility of building shared energy infrastructure for the region, the council is gathering a wide range of information about government policy trends and assessments of the safety, economic viability, and procurement reliability of hydrogen and other types of energy. The council is also evaluating practical measures and road maps in collaboration with local governments.

Risk Management

Risk Management

The DBJ Group recognizes that being underprepared for climate change is a risk that could significantly impact on management. It therefore analyzes potential impacts based on a range of scenarios and formulates initiatives and policies to deal with this risk. The DBJ Group has introduced business-specific policies for investments and loans in particular sectors, and monitors progress in partnership with the Sustainability Committee.

Initiatives Based on Environmental and Social Management Policy for Financing and Investment Activity

In 2021, the DBJ Group set policies for investments and loans for businesses likely to entail major risks or negative impacts on the environment and society, and for finance for specific sectors. In fiscal 2022, DBJ is reviewing these policies as necessary.

Operations Based on the Equator Principles

The DBJ Group adopted the Equator Principles in 2020 and uses them as the basis for identifying, assessing, and managing the environmental and social risks associated with large-scale projects, with guidance from the Environmental & Social Assessment Office.

Operations Based on the Poseidon Principles

The Poseidon Principles were created as a framework for financial institutions to deal with climate change risks in the marine transportation industry. The DBJ Group became a signatory in 2021, and every year discloses its contributions to reducing GHG emissions in the context of ship financing. We endeavor to provide investments and loans that take climate change risks into account.

Indicators and Targets

Climate Change-Related Targets at Companies Receiving Investments and Loans

DBJ has set a target of ¥5.5 trillion in investments and loans related to its GRIT Strategy over the five-year period of its Fifth Medium-Term Management Plan. In fiscal 2021, DBJ made ¥754.4 billion in investments and loans. With an eye on future targets, we will proactively support initiatives to tackle climate change at companies receiving investments and loans from us.

GHG Emissions Targets

The DBJ Group intends to pursue net zero emissions by 2050, not only for Scope 1 (direct emissions) and Scope 2 (indirect emissions) but also for Scope 3 (emissions from investments and loans).

Scope 1 and 2

Scope 1 and Scope 2 GHG emissions from corporate activities are measured and tallied for DBJ and eight major domestic Group companies. DBJ has created an environmental management system overseen by the managing executive officer in charge of the Corporate Planning & Coordination Department and promotes ongoing initiatives to achieve improvement targets and make specific contributions to the environment.

| Results Fiscal 2019 | Results Fiscal 2020 | Results Fiscal 2021 |

|---|---|---|

| 3,270t-CO2 | 3,074t-CO2 | 2,473t-CO2 |

Scope: DBJ Head Office, 10 branch offices, eight representative offices, DBJ Capital Co., Ltd., DBJ Securities Co., Ltd., DBJ Asset Management Co., Ltd., Japan Economic Research Institute Inc., Value Management Institute Inc., DBJ Real Estate Co., Ltd., Consist Inc., DBJ Business Support Co., Ltd.

Items covered: Scope 1: Gasoline in company vehicles

Scope 2: Electricity, fuel (kerosene, fuel oil, coal gas, city gas)

Scope 3

Based on its policy of achieving net zero GHG emissions for its portfolio of investments and loans by 2050, the DBJ Group is committed to measuring and disclosing its GHG emissions. We believe it will be important to measure and monitor Scope 3 emissions along with the amount of credit provided to sectors that emit large quantities of GHG emissions, such as energy and transportation.

While deepening our understanding of measurement methodologies in this context, we are validating and estimating GHG emissions in the energy sector following the methodology of the Global GHG Accounting and Reporting Standard for the Financial Industry, which was developed by the Partnership for Carbon Accounting Financials (PCAF).

PCAF Methodology

Regarding detailed measurement methods for GHG emissions via investments and loans, the Global GHG Accounting and Reporting Standard for the Financial Industry is used to validate and estimate GHG emissions in each class of assets for investment and loan activities for financial institutions.

Future Policies

The DBJ Group will measure Scope 3 emissions while considering the following main validation issues in measurement.

-

(1)

We will select the energy sector (electricity, oil, and gas) as the sector for measurement.

-

(2)

We will continue to examine the best indicators for disclosure (emissions intensity, absolute emissions, etc.).

-

(3)

We will aim to improve the quality of emissions data gathering by updating data gathering methods in stages with reference to ongoing dialogue with customers.

- Sustainability

- Sustainability News

- Message from the President

- Sustainability Management System

- Policy on Sustainability

- DBJ Group Human Rights Policy

- Value Creation Process

- Priority Areas for the Achievement of Vision 2030

- Resolving Social Issues and Creating Value Through Our Core Businesses

- Fundamental Activities

- Collaboration with Stakeholders