DBJ Sustainability Linked Loans with Engagement Dialogue

What are sustainability linked loans with engagement dialogue?

Sustainability linked loans are financial instruments whose aim is to achieve sustainable growth for both borrowers and society as a whole. Based on the Sustainability Linked Loan Principles drawn up by the Loan Market Association and the Green Loan and Sustainability Linked Loan Guidelines issued by the Ministry of the Environment, they work by incentivizing the linkage of loan terms and conditions to the achievement of targets – sustainability performance targets, or SPTs – consistent with the borrower's sustainability strategy.

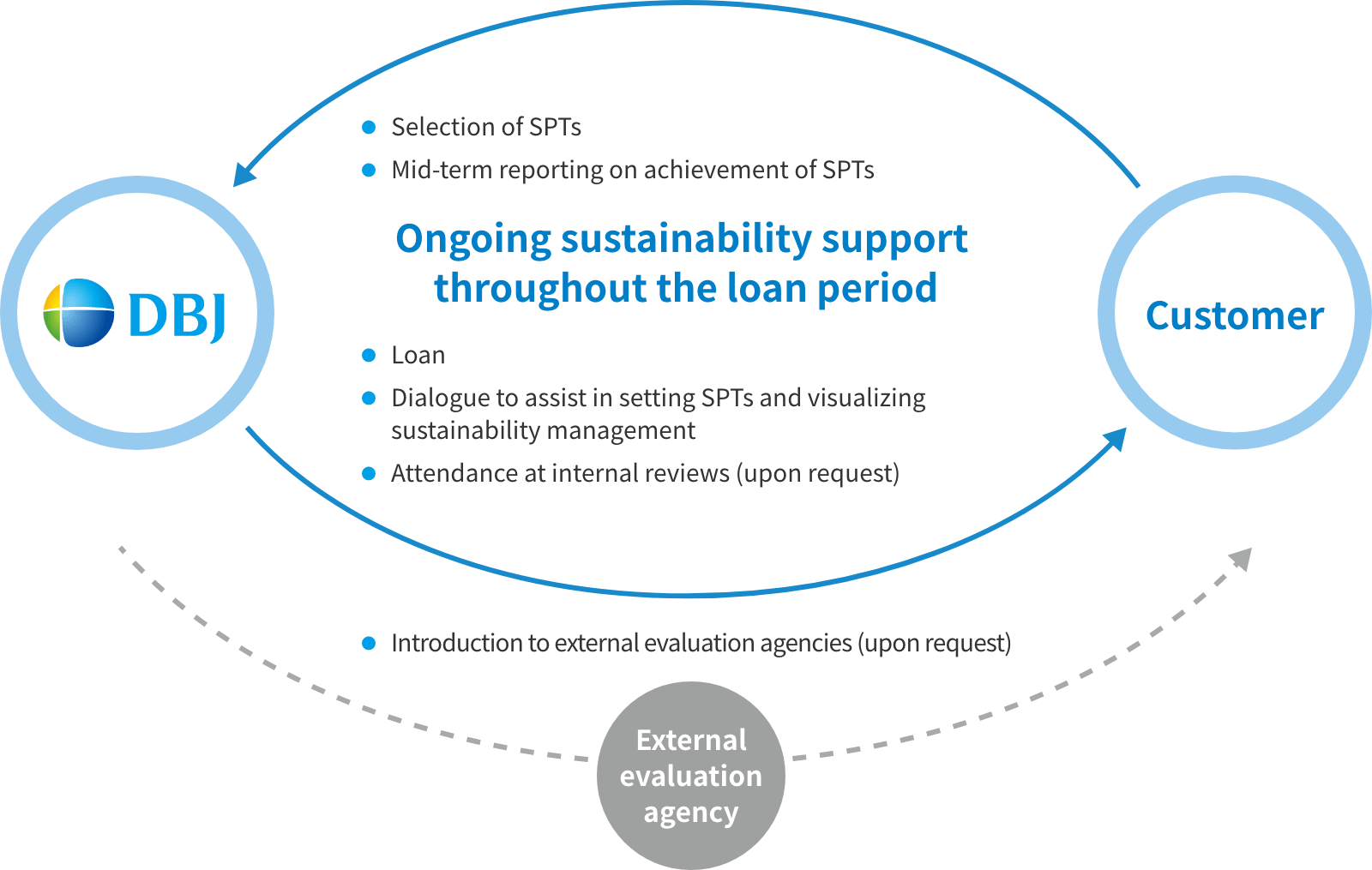

Under DBJ sustainability linked loans with engagement dialogue, we engage with our borrowers to set the SPTs which can best motivate them to raise the level of their sustainability management and achieve the goals that the SPTs represent.

Customers benefit from visualizing sustainability initiatives through dialogue with DBJ while enjoying the positive publicity that comes with structuring a sustainability linked loan.

DBJ sustainability linked loans with engagement dialogue is one way in which we encourage sustainability management among our customers while promoting the growth of a sustainable society.

Conceptual diagram

- Service

- Medium- to Long-Term Loans

- Structured Finance

- Asset Financing (Real Estate)

- Syndicated Loans

- Asset-Based Lending (ABL)

- Debtor-in-Possession Financing

- Crisis Response Operations

- Mezzanine Financing

- LBOs / MBOs

- Equity

- Collaborative Fund Operations

- Special Investment Operations

- DBJ Sustainable Solutions(Open in new window)

- DBJ Certification Programs

- DBJ Sustainability Linked Loans with Engagement Dialogue

- DBJ Green Building Certification

- The DBJ Visionary Hospital Program

- Regional Emergency Response Program

- M&A Advisory Services

- Support for Startups

- Support for Innovation

- Public Asset Management

- Asset Management