M&A Advisory Services

About M&A Advisory Services

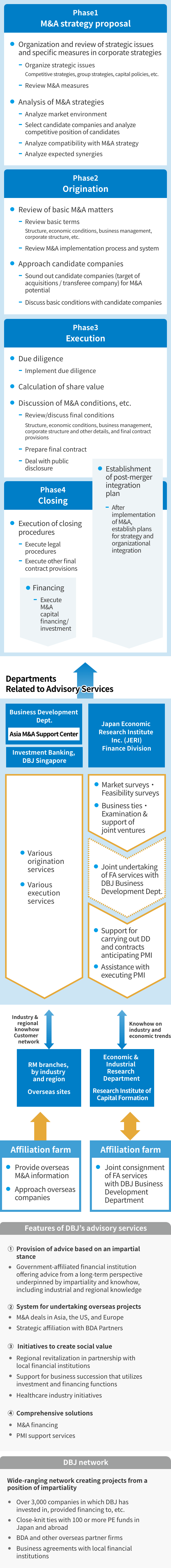

Amid the backdrop of initiatives to promote the revitalization of industrial restructuring and corporate growth strategies, DBJ provides advisory services in various business settings, including Japanese company entry into overseas markets, management integration and alliances, core business fortification and non-core business spin-off, business succession, and capital policy undertakings (e.g., the delisting of companies).

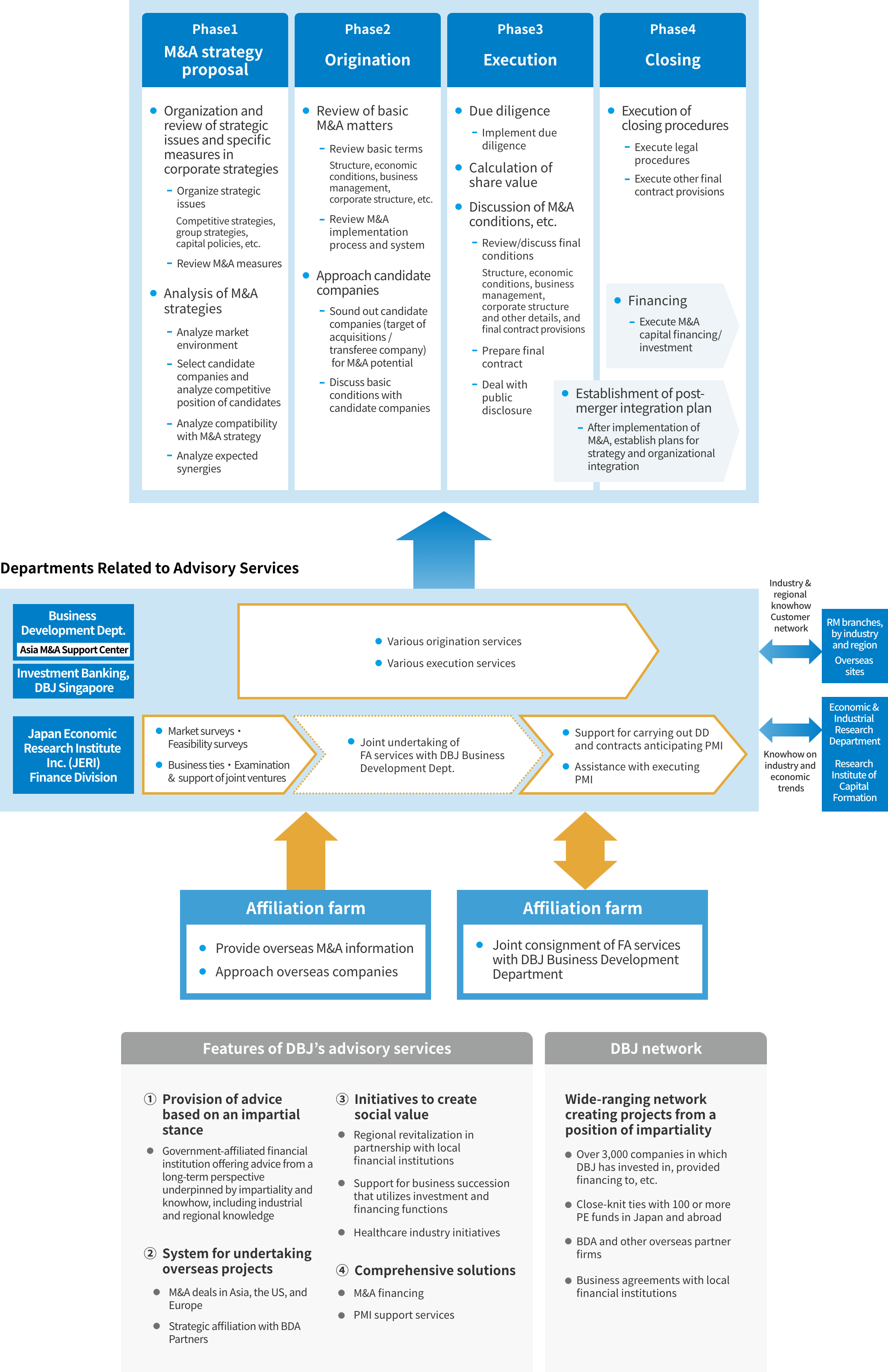

The following examples evince general characteristics of DBJ’s M&A advisory services: advice focusing on a long-term outlook and creation of social value; a system that promotes overseas projects, handled mainly by DBJ Group assets in Asia but also by our subsidiaries in the US and Europe; and the Group’s comprehensive financial services, including industry analysis, market research, and post-merger integration and M&A financing. We address various corporate needs and comprehensively propose and provide M&A solutions that correspond to our clients’ respective corporate strategies.

M&A process and DBJ M&A Advisory Services provision system

Related information

- Service

- Medium- to Long-Term Loans

- Structured Finance

- Asset Financing (Real Estate)

- Syndicated Loans

- Asset-Based Lending (ABL)

- Debtor-in-Possession Financing

- Crisis Response Operations

- Mezzanine Financing

- LBOs / MBOs

- Equity

- Collaborative Fund Operations

- Special Investment Operations

- DBJ Sustainable Solutions(Open in new window)

- DBJ Certification Programs

- DBJ Sustainability Linked Loans with Engagement Dialogue

- DBJ Green Building Certification

- The DBJ Visionary Hospital Program

- Regional Emergency Response Program

- M&A Advisory Services

- Support for Startups

- Support for Innovation

- Public Asset Management

- Asset Management