Special Investment Operations

About Special Investment Operations

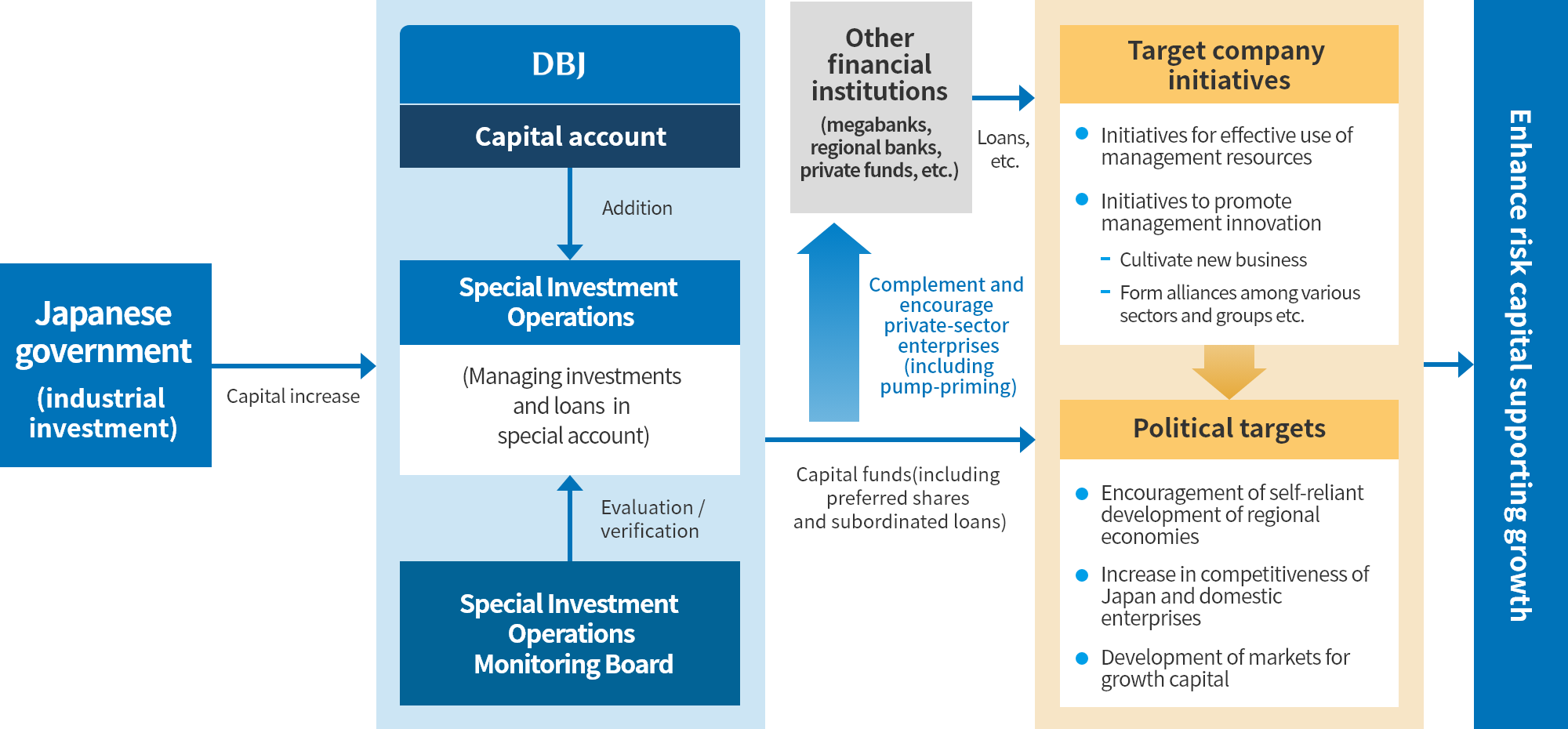

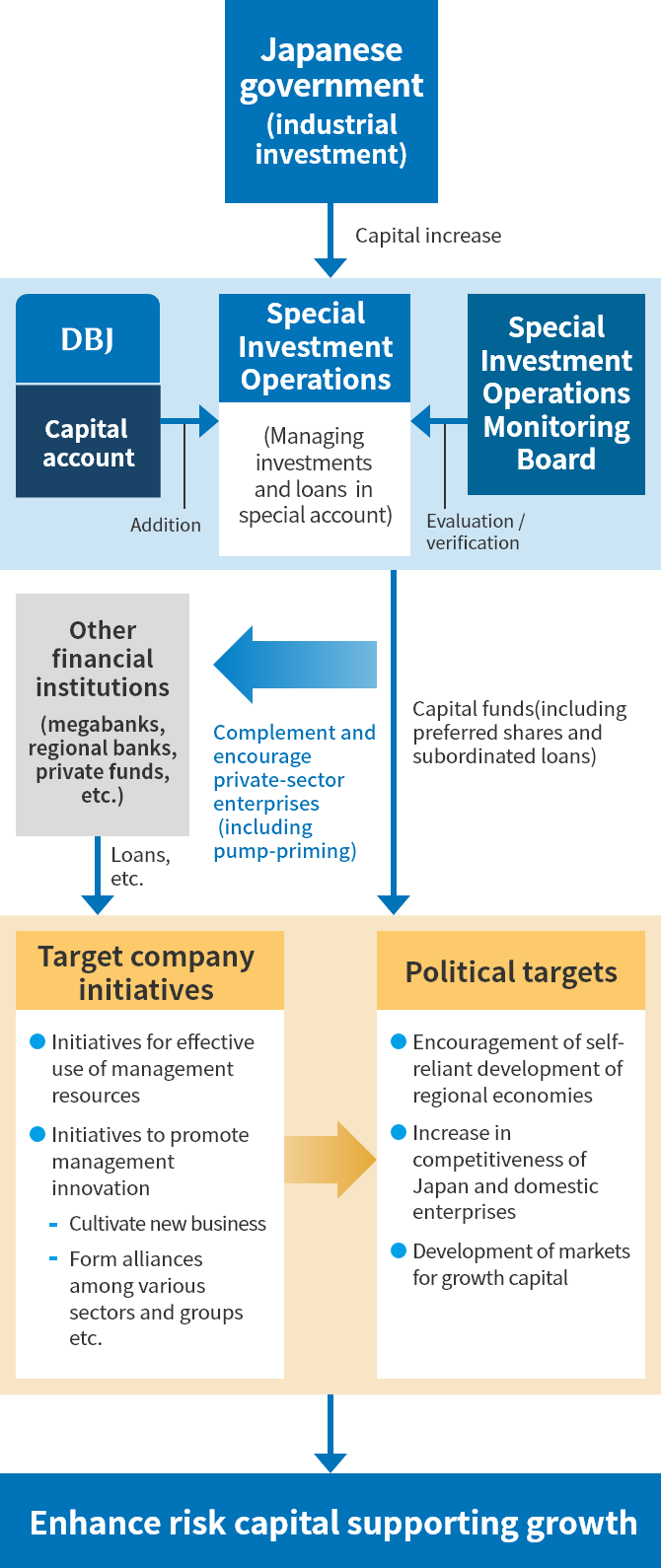

Special Investment Operations, established as an intensive but temporary scheme to supply growth capital from the perspective of promoting the competitiveness of Japanese enterprises along with regional revitalization, draws only a portion of the investment (industrial investment) from the Japanese government - enough to encourage the private sector to supply growth capital. Since launching the aforementioned operations in June 2015, DBJ has made ¥998.2 billion (as of March 31, 2022) in investments and loans (152 projects in total), the first ¥962.1 billion of which has spurred ¥6,231.3 billion in private-sector investments and loans.

Scheme

Overview of Special Investment Operations

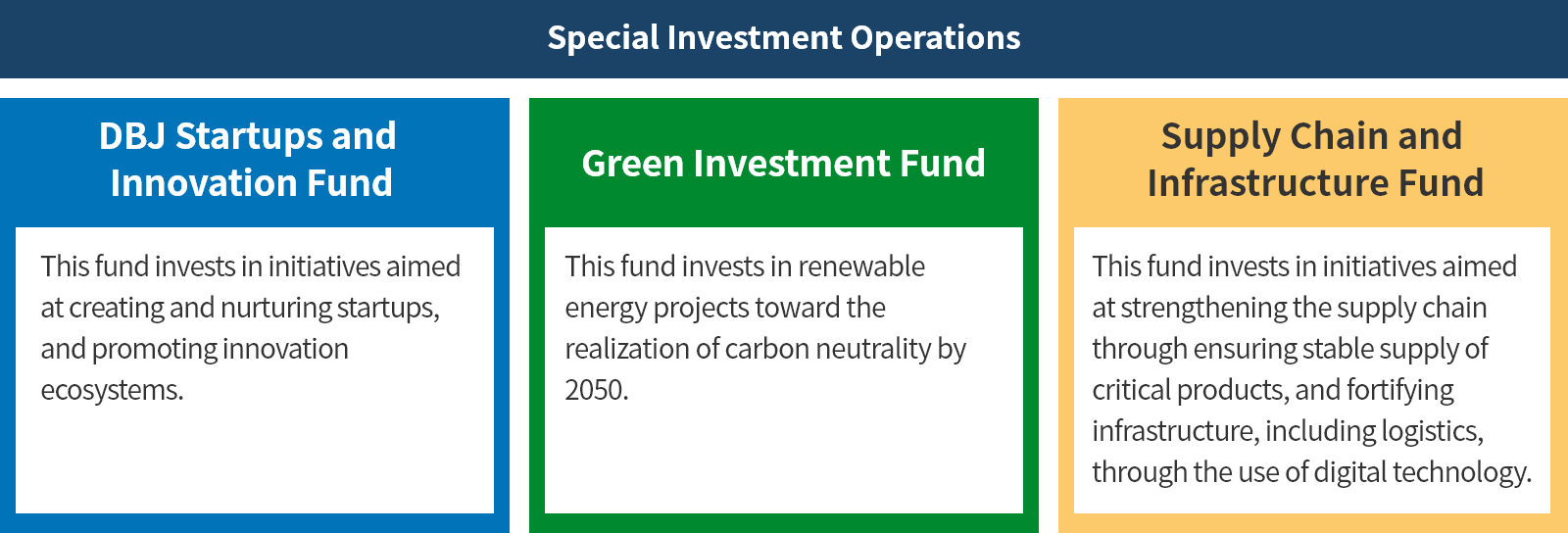

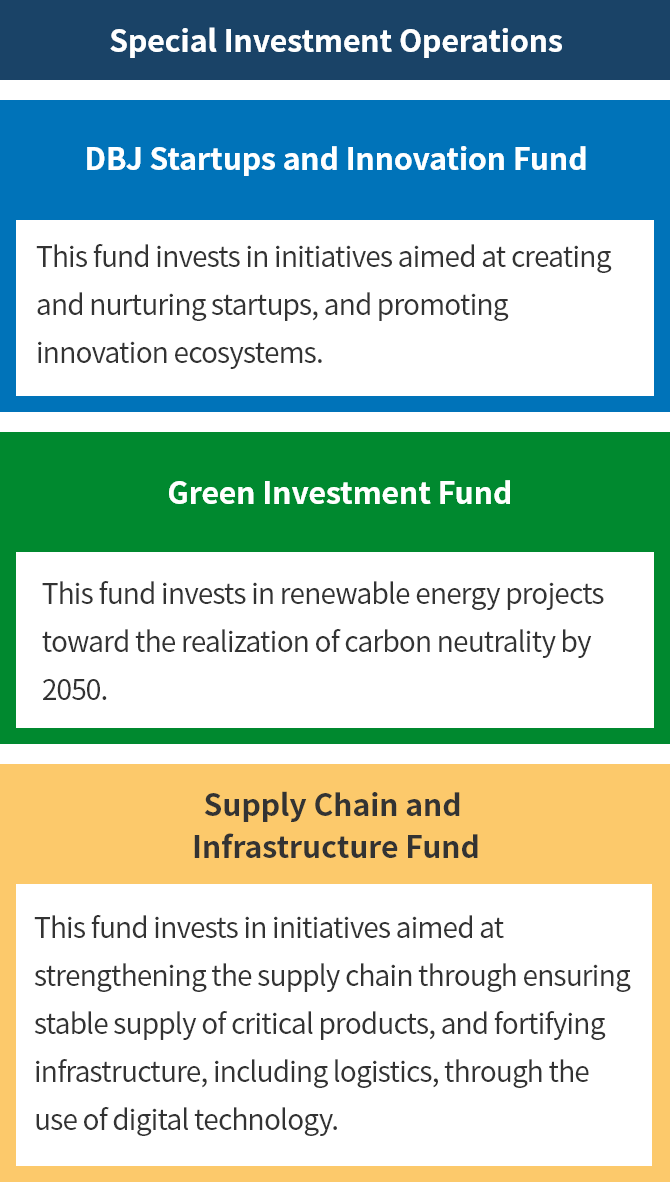

For its Special Investment Operations, to clarify priority areas for assistance, DBJ has set up the following three funds.

DBJ Startups and Innovation Fund

In light of the June 7, 2022, Cabinet decision “Basic Policy on Economic and Fiscal Management and Reform 2022,” in November 2022, we renamed the DBJ Innovation and Life Sciences Fund, which was established in March 2021, to clarify our support for creation and development of startups.

Green Investment Fund

This fund was created in February 2021, to support businesses that aim to improve the sustainability of natural resources and the environment, such as renewable energy businesses, in consideration of the December 8, 2020, Cabinet decision Comprehensive Economic Measures to Secure People’s Lives and Livelihoods toward Relief and Hope.

Supply Chain and Infrastructure Fund

In accordance with the Comprehensive Economic Measures for Complete Deflation Exit (Cabinet decision on November 2, 2024), we have set up this fund in February 2024 to support initiatives for strengthening supply chain and enhancing national resilience.

Related information

- Service

- Medium- to Long-Term Loans

- Structured Finance

- Asset Financing (Real Estate)

- Syndicated Loans

- Asset-Based Lending (ABL)

- Debtor-in-Possession Financing

- Crisis Response Operations

- Mezzanine Financing

- LBOs / MBOs

- Equity

- Collaborative Fund Operations

- Special Investment Operations

- DBJ Certification Programs

- DBJ Sustainability Linked Loans with Engagement Dialogue

- DBJ Green Building Certification

- The DBJ Visionary Hospital Program

- Regional Emergency Response Program

- M&A Advisory Services

- Support for Startups

- Support for Innovation

- Public Asset Management

- Asset Management