Crisis Response Operations

About Crisis Response Operations

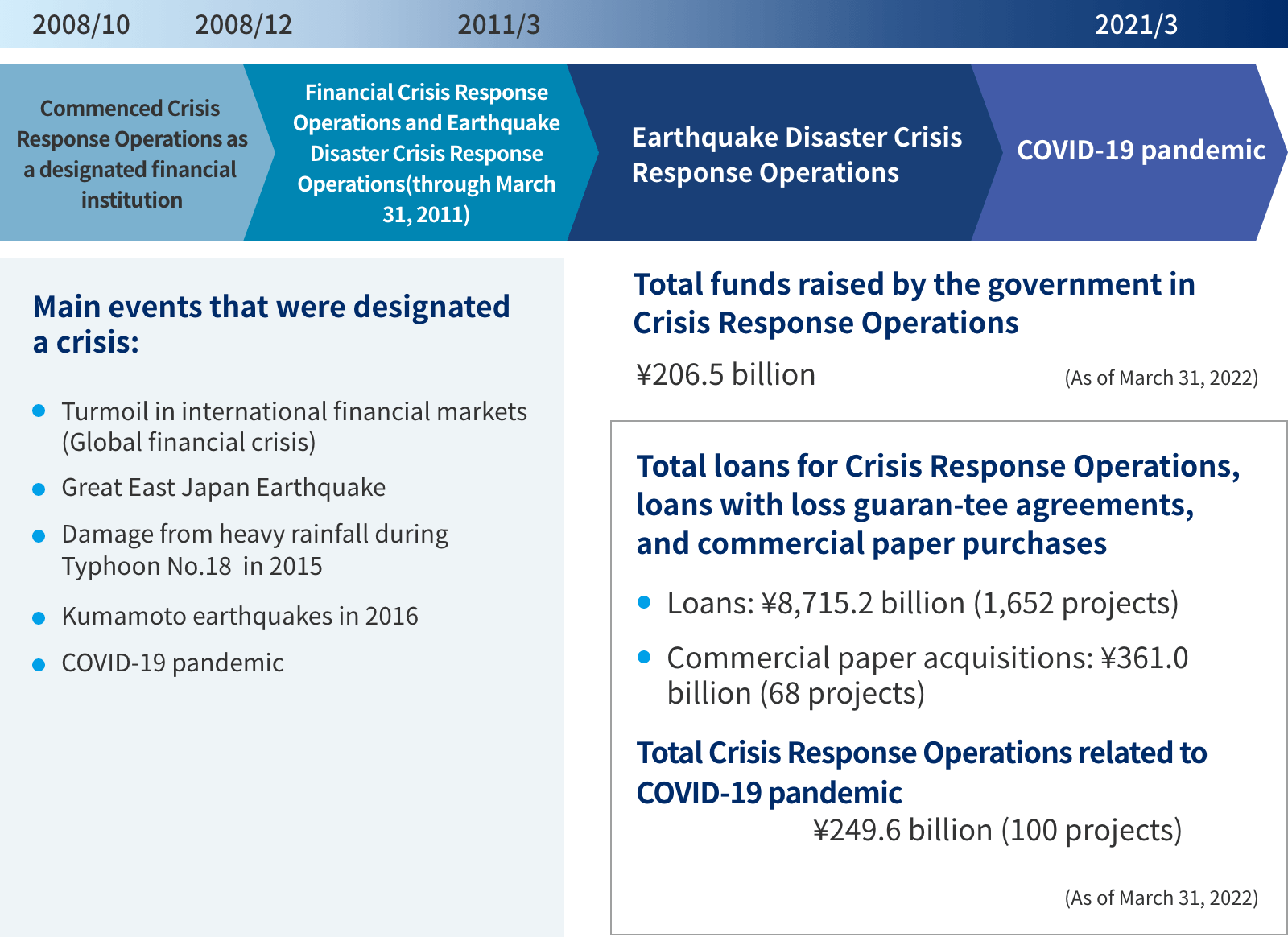

DBJ’s Crisis Response Operations function as a stabilizing force during periods of instability in the economy, society, and markets.

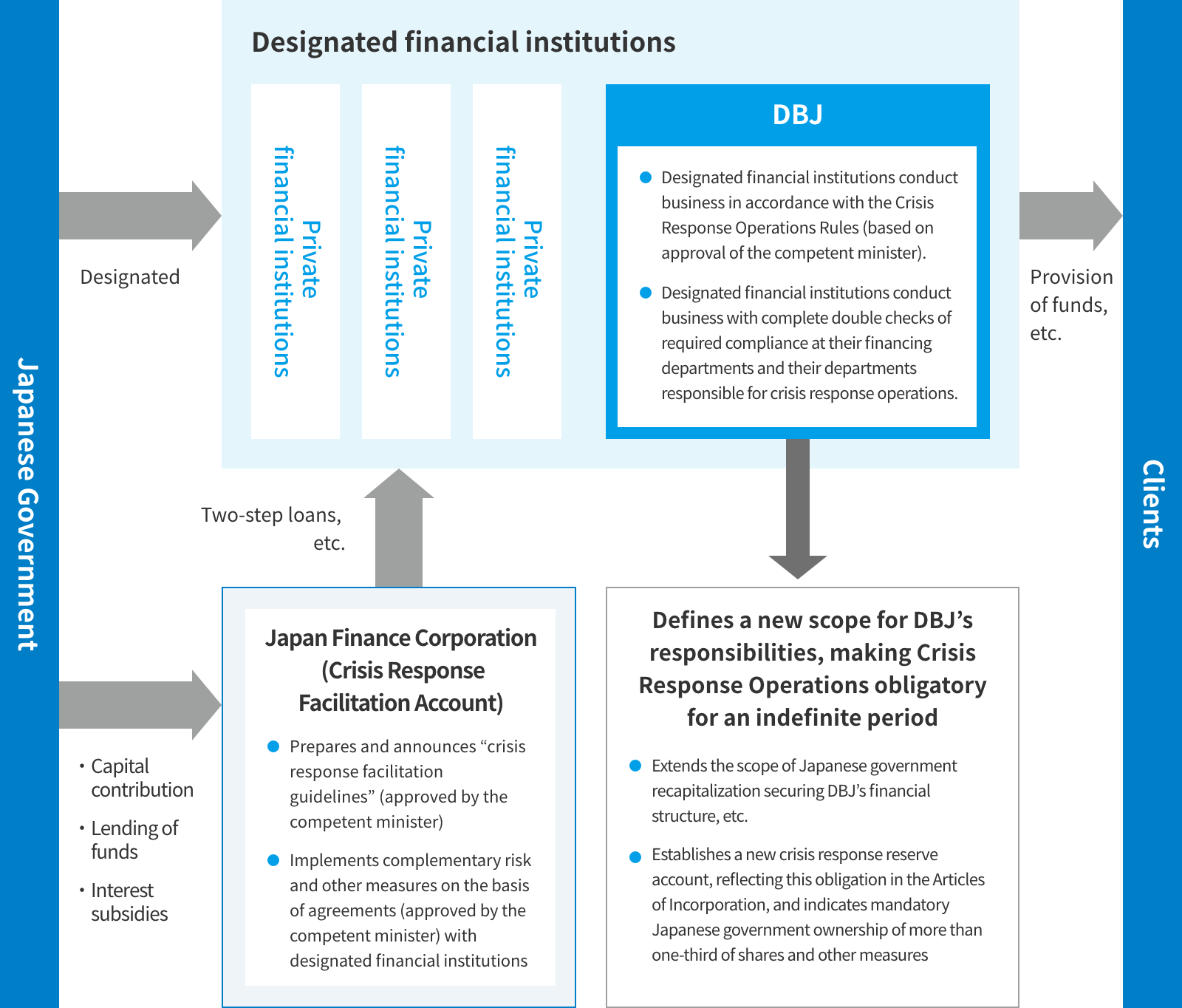

The Finance Corporation Act (Act No. 57 of 2007, including later revisions), mandates the provision of necessary funds during such crises as disruptions in domestic or overseas financial markets or large-scale disasters. In response to crisis-related damage, Japan Finance Corporation provides two-step loans as a complementary risk measure, among other measures, to government-designated financial institutions that supply necessary funds to address such damage.

In March 2020, the COVID-19 pandemic was designated a crisis. As a designated financial institution, DBJ collaborated and coordinated with private-sector financial institutions to rapidly and effectively implement Crisis Response Operations.

Scheme

Accomplishments and Initiatives to Date

Related information

- Service

- Medium- to Long-Term Loans

- Structured Finance

- Asset Financing (Real Estate)

- Syndicated Loans

- Asset-Based Lending (ABL)

- Debtor-in-Possession Financing

- Crisis Response Operations

- Mezzanine Financing

- LBOs / MBOs

- Equity

- Collaborative Fund Operations

- Special Investment Operations

- DBJ Certification Programs

- DBJ Sustainability Linked Loans with Engagement Dialogue

- DBJ Green Building Certification

- The DBJ Visionary Hospital Program

- Regional Emergency Response Program

- M&A Advisory Services

- Support for Startups

- Support for Innovation

- Public Asset Management

- Asset Management