Mezzanine Financing

About Mezzanine Financing

Mezzanine financing is a form of intermediate financing that falls between the classification of a senior loan undertaken by conventional financial institutions and equity financing using common shares.

There are various classification of mezzanine financing, including subordinate loans or bonds, preferred or class shares, and hybrid financing. The priority of repayment for these forms of financing is lower than for senior loans, meaning a higher level of risk. Economic rationale is attained by setting the level of interest and dividend payments commensurate with investment risk.

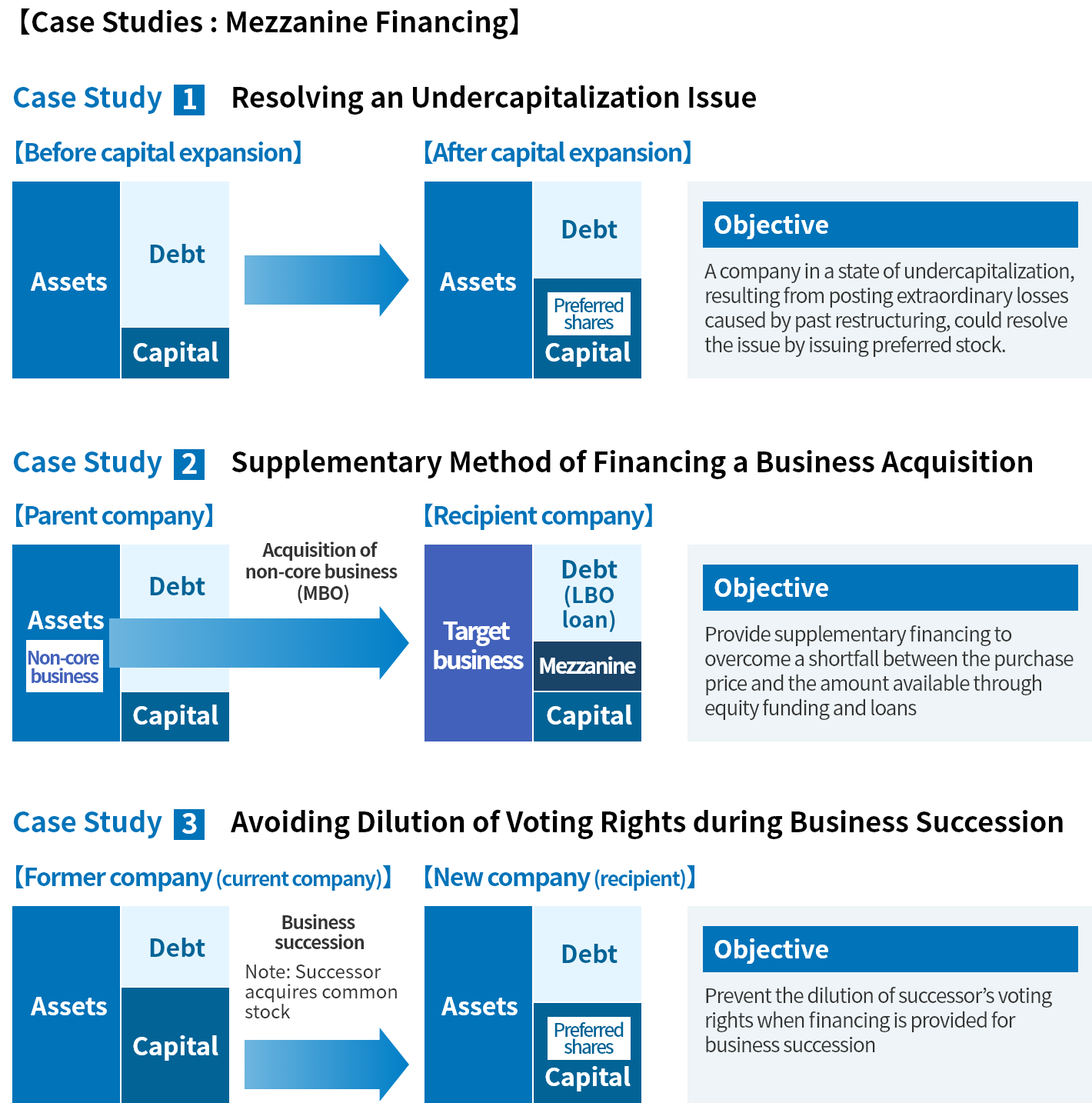

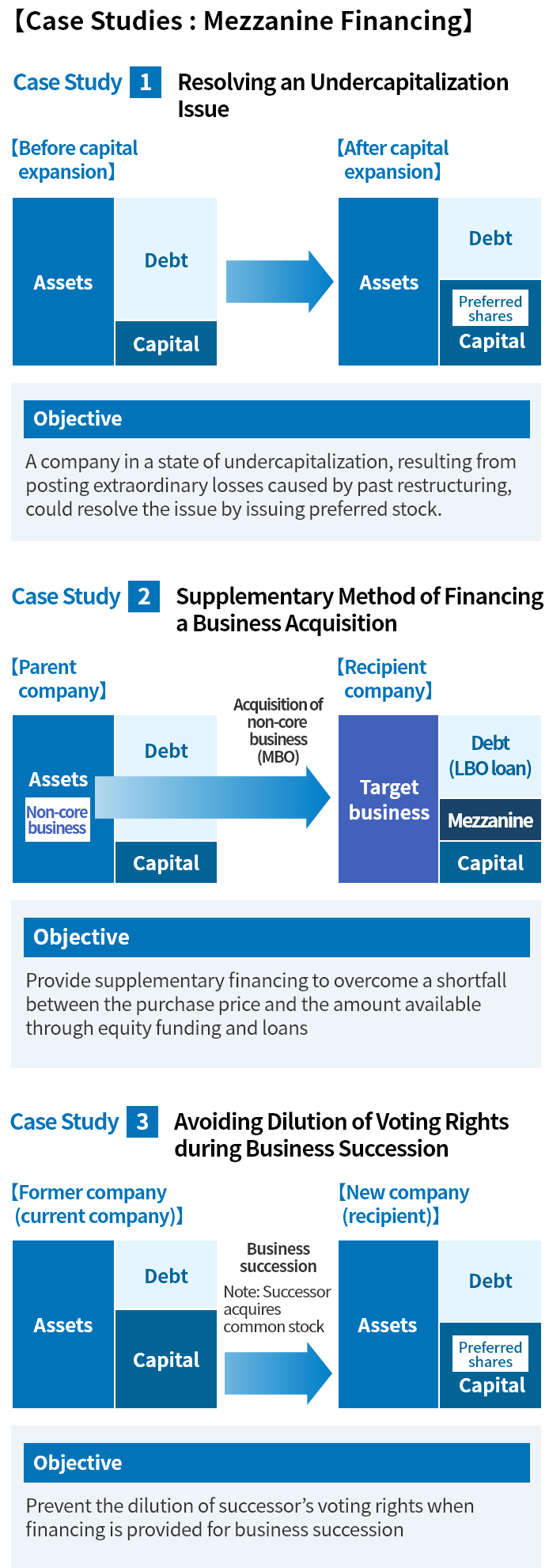

Customer benefits of mezzanine financing include flexible redemption schedules and exit methods and the ability of existing shareholders to avoid dilution of their voting rights. In addition, given that it is possible to flexibly design financing in accordance with capital plans and capital policies, in recent years there have been rising needs among corporate clients to strengthen their financial infrastructures, acquire businesses, carve out subsidiaries and businesses, execute business successions, and take companies private.

DBJ is providing total solutions, from developing financing schemes to financing arrangements and risk management, based on a long-term outlook toward solving our clients’ balance sheet issues.

Preferred shares

In contrast to common shares, preferred shares have a higher priority for payment of dividends and allocation of residual assets. These shares offer a high dividend payout ratio, as they generally do not come with voting rights. In some cases, they have an equity kicker (stock acquisition rights, rights for conversion to common shares). It is possible to increase capital without changing the ratio of voting rights. However, it should be noted that such procedures necessitate revision of the articles of incorporation and do not result in tax-saving benefits.

Subordinated loans

This type of debt has a lower repayment ranking and dividend payment ranking in the event of liquidation. In some cases, they have an equity kicker (stock acquisition rights, rights for conversion to common shares). The office procedures for borrowers are easier than for preferred shares. Although there are tax-saving benefits, it should be noted that ???? for subordinated loans than for preferred shares.

Hybrid financing

This is a type of mezzanine financing. In cases where the client receives a certain degree of capital certification by a ratings agency, this financing is called a subordinated loan or preferred shares.

Scheme

Related information

- Service

- Medium- to Long-Term Loans

- Structured Finance

- Asset Financing (Real Estate)

- Syndicated Loans

- Asset-Based Lending (ABL)

- Debtor-in-Possession Financing

- Crisis Response Operations

- Mezzanine Financing

- LBOs / MBOs

- Equity

- Collaborative Fund Operations

- Special Investment Operations

- DBJ Certification Programs

- DBJ Sustainability Linked Loans with Engagement Dialogue

- DBJ Green Building Certification

- The DBJ Visionary Hospital Program

- Regional Emergency Response Program

- M&A Advisory Services

- Support for Startups

- Support for Innovation

- Public Asset Management

- Asset Management