Collaborative Fund Operations

About Collaborative Fund Operations

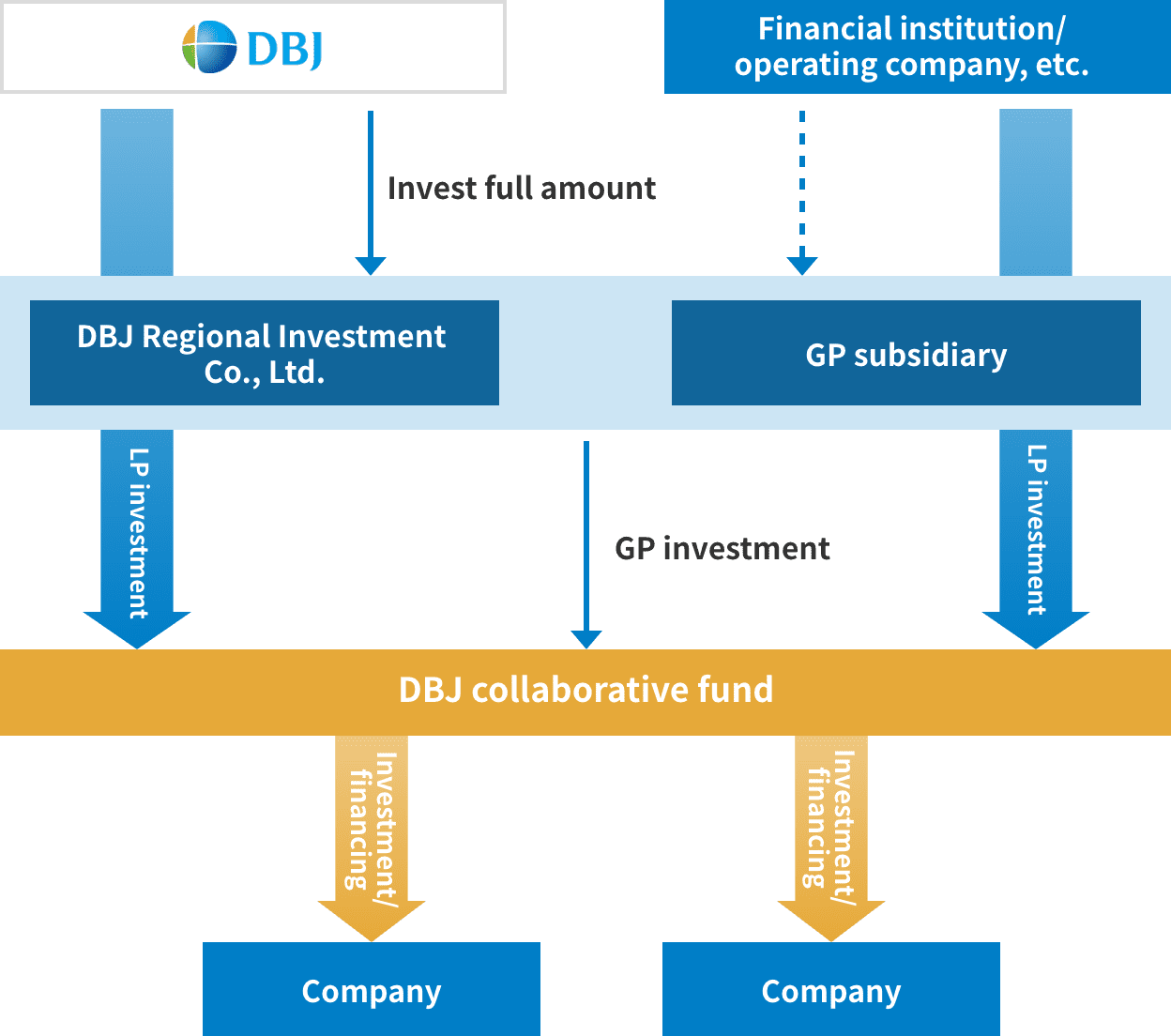

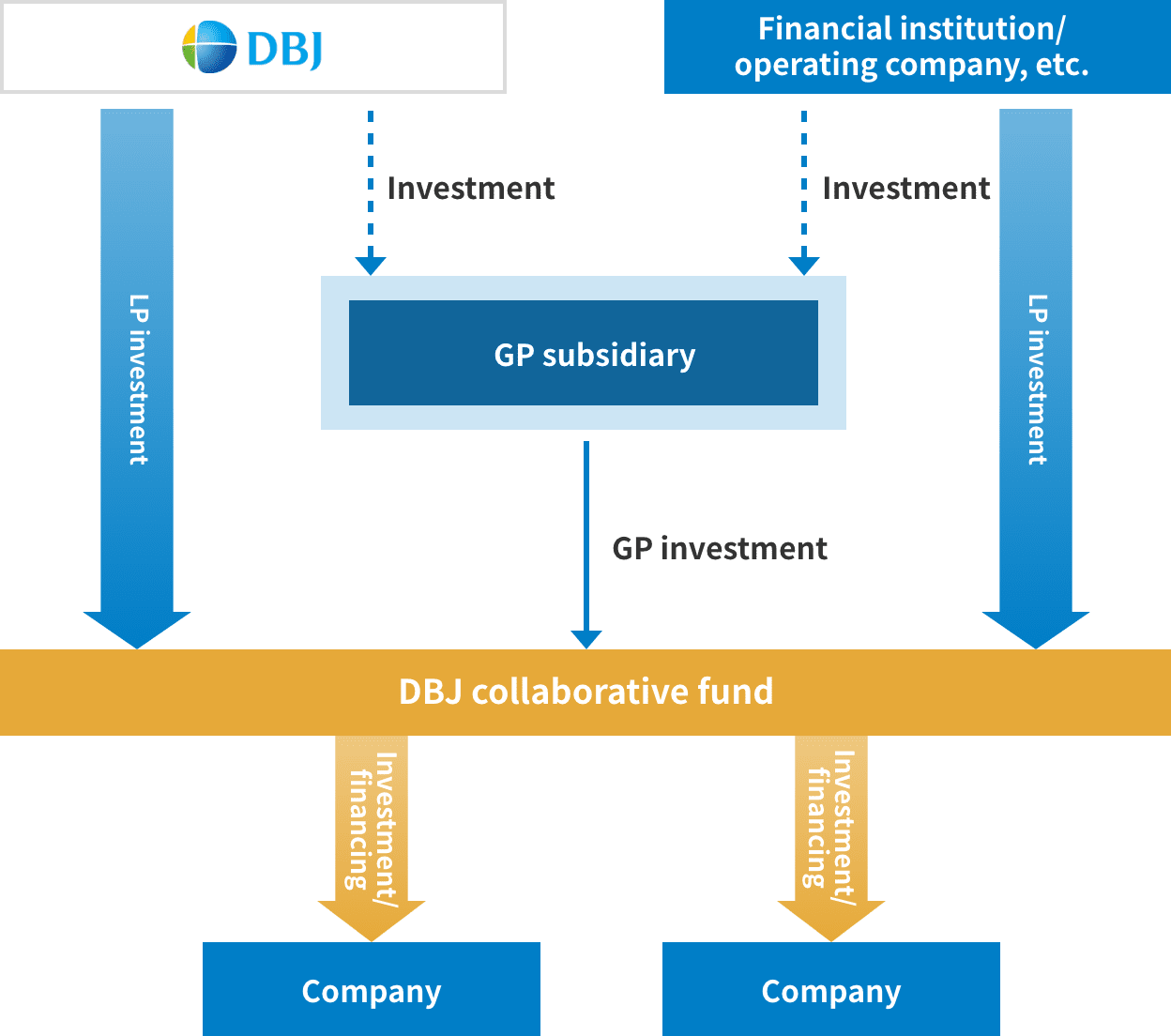

DBJ carries out collaborative fund operations by creating funds in cooperation with other financial institutions or operating companies. Through these funds, mezzanine, equity, or other risk money is supplied to individual companies.

The benefit of collaborative funds for customers includes the provision of financing to business partners that would be difficult to provide alone and the expansion of investment opportunities via risk sharing with DBJ.

To address the needs of clients, DBJ develops and operates collaborative funds based on diverse themes, including disaster reconstruction, growth support, tourism revitalization, and business succession. DBJ provides solutions by exerting knowhow on fund management and risk money supply.

Scheme

Joint GP patter

Newly established GP pattern

Related information

- Service

- Medium- to Long-Term Loans

- Structured Finance

- Asset Financing (Real Estate)

- Syndicated Loans

- Asset-Based Lending (ABL)

- Debtor-in-Possession Financing

- Crisis Response Operations

- Mezzanine Financing

- LBOs / MBOs

- Equity

- Collaborative Fund Operations

- Special Investment Operations

- DBJ Sustainable Solutions(Open in new window)

- DBJ Certification Programs

- DBJ Sustainability Linked Loans with Engagement Dialogue

- DBJ Green Building Certification

- The DBJ Visionary Hospital Program

- Regional Emergency Response Program

- M&A Advisory Services

- Support for Startups

- Support for Innovation

- Public Asset Management

- Asset Management