Debtor-in-Possession Financing

About Debtor-in-Possession Financing

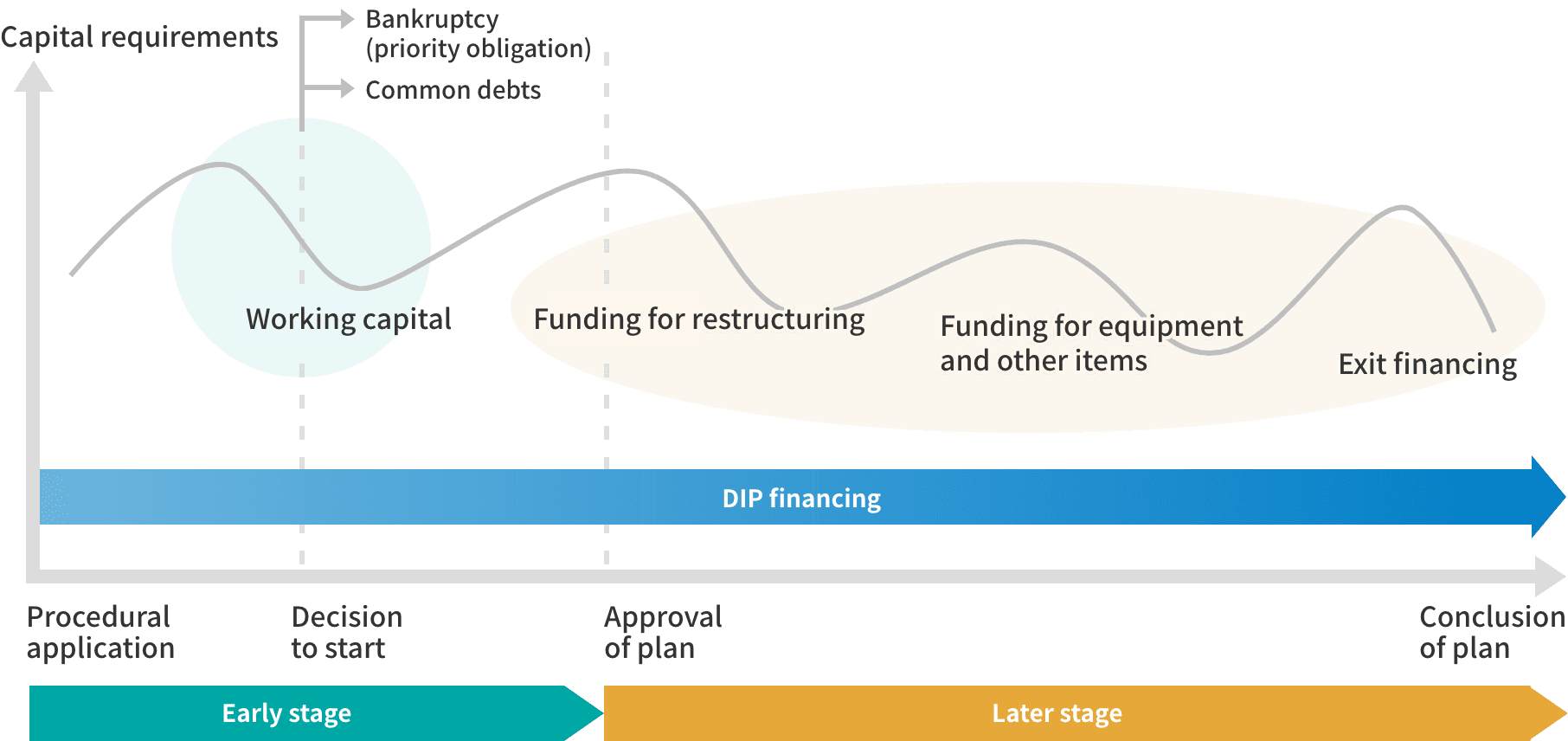

Debtor-in-possession (DIP) financing is a type of financing provided to companies from the time they petition for the commencement of rehabilitation/reorganization proceedings to the completion of said proceedings under the Civil Rehabilitation Act or Corporate Reorganization Act. Both early and later DIP financing are available. Early DIP financing is for companies that are unable to procure working capital, due to rehabilitation/reorganization, and are having difficulty sustaining their business operations during the stage between completion of the petitioning for the commencement of rehabilitation/reorganization and final approval of the rehabilitation/reorganization plan. Early DIP provides temporary working capital to maintain the value of said business operations.

Later DIP financing is for companies in the stage after their rehabilitation/reorganization plan has been approved. Later DIP financing provides the restructuring capital needed to implement the rehabilitation/reorganization plan, medium- to long-term financing for capital expenditures, financing to acquire the right of exclusion during the rehabilitation/reorganization plan, refinancing of rehabilitation claims, or capital to quickly wind up the legal liquidation process (exit financing).

In 2001, DBJ implemented DIP financing to mitigate financial system issues that arose in tandem with the non-performing loan issue in the late 1990s. Through this financing, DBJ supported the continuity and development of valuable businesses at a time when companies were struggling.

Scheme

Related information

- Service

- Medium- to Long-Term Loans

- Structured Finance

- Asset Financing (Real Estate)

- Syndicated Loans

- Asset-Based Lending (ABL)

- Debtor-in-Possession Financing

- Crisis Response Operations

- Mezzanine Financing

- LBOs / MBOs

- Equity

- Collaborative Fund Operations

- Special Investment Operations

- DBJ Certification Programs

- DBJ Sustainability Linked Loans with Engagement Dialogue

- DBJ Green Building Certification

- The DBJ Visionary Hospital Program

- Regional Emergency Response Program

- M&A Advisory Services

- Support for Startups

- Support for Innovation

- Public Asset Management

- Asset Management