Syndicated Loans

About Syndicated Loans

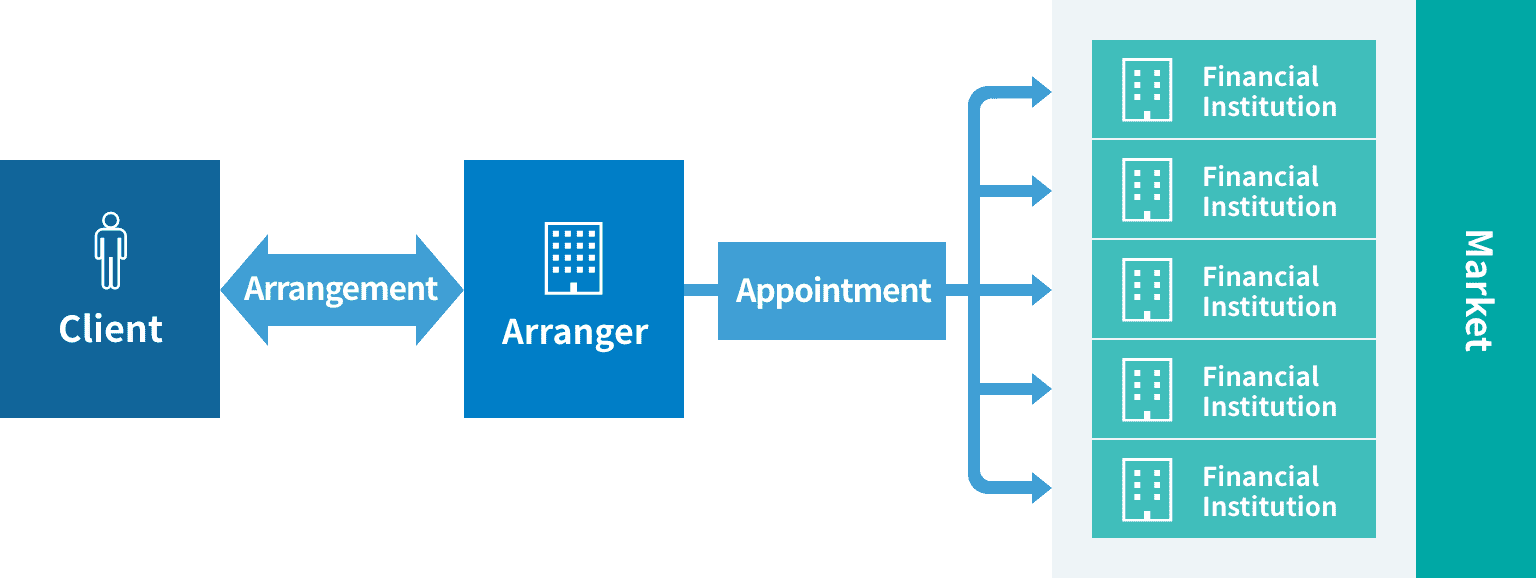

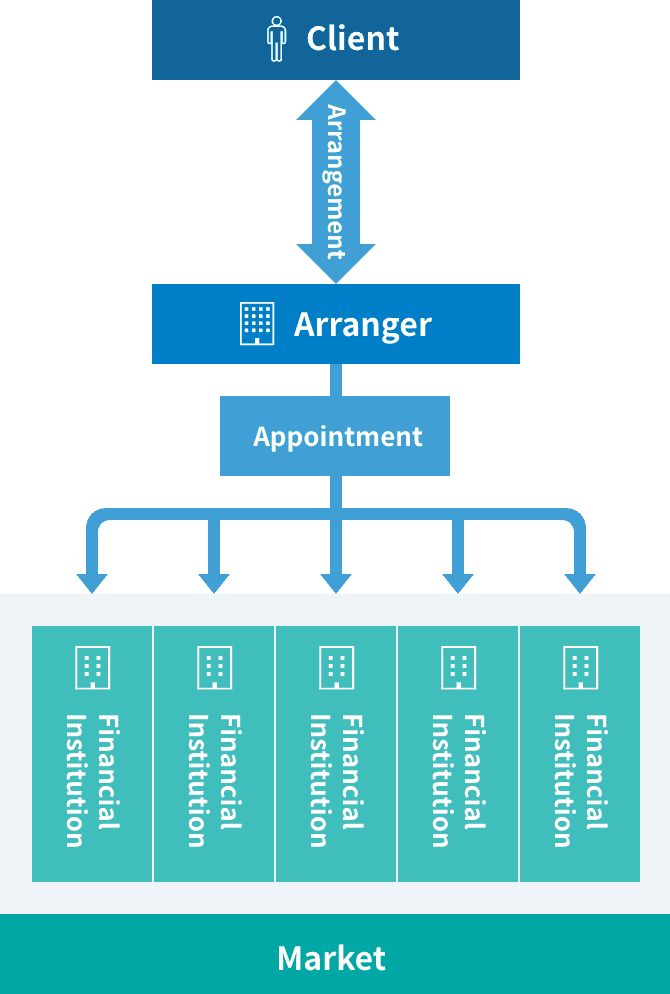

A syndicated loan is a financing arrangement by a group of lenders (syndicated group) consisting of several financial institutions organized by an arranger (managing financial institution). The group works together to provide financing based on a single contract under the same contractual conditions.

The benefits for customers include alleviating the burden of negotiations with a financial institution by centralizing operations with the arranger, who serves as the main contact; alleviating the burden of office management by having the agent handle financial settlements and other tasks; flexibly procuring large capital amounts; expanding the scope of transactions with financial institutions, through invitation by the arranger; and securing transparency of borrowing conditions.

DBJ provides distinct services that improve value in combination mainly with its unique financing menu, including active financing arrangements; mainly term loans; a wide range of financial institutions it can collaborate with using its impartial position; and its Environmentally Rated Loan Program.

Scheme

Related information

- Service

- Medium- to Long-Term Loans

- Structured Finance

- Asset Financing (Real Estate)

- Syndicated Loans

- Asset-Based Lending (ABL)

- Debtor-in-Possession Financing

- Crisis Response Operations

- Mezzanine Financing

- LBOs / MBOs

- Equity

- Collaborative Fund Operations

- Special Investment Operations

- DBJ Certification Programs

- DBJ Sustainability Linked Loans with Engagement Dialogue

- DBJ Green Building Certification

- The DBJ Visionary Hospital Program

- Regional Emergency Response Program

- M&A Advisory Services

- Support for Startups

- Support for Innovation

- Public Asset Management

- Asset Management