Asset-Based Lending (ABL)

About Asset-Based Lending

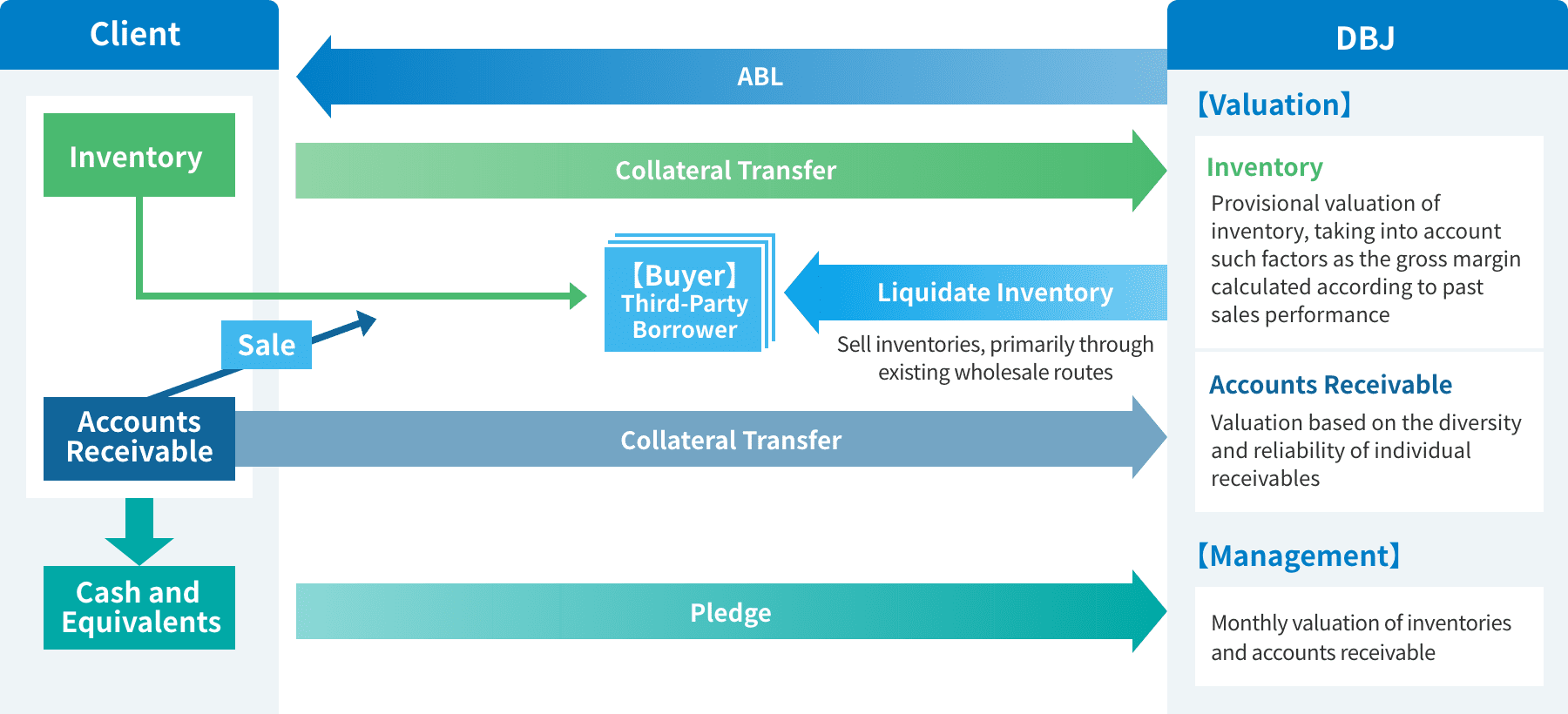

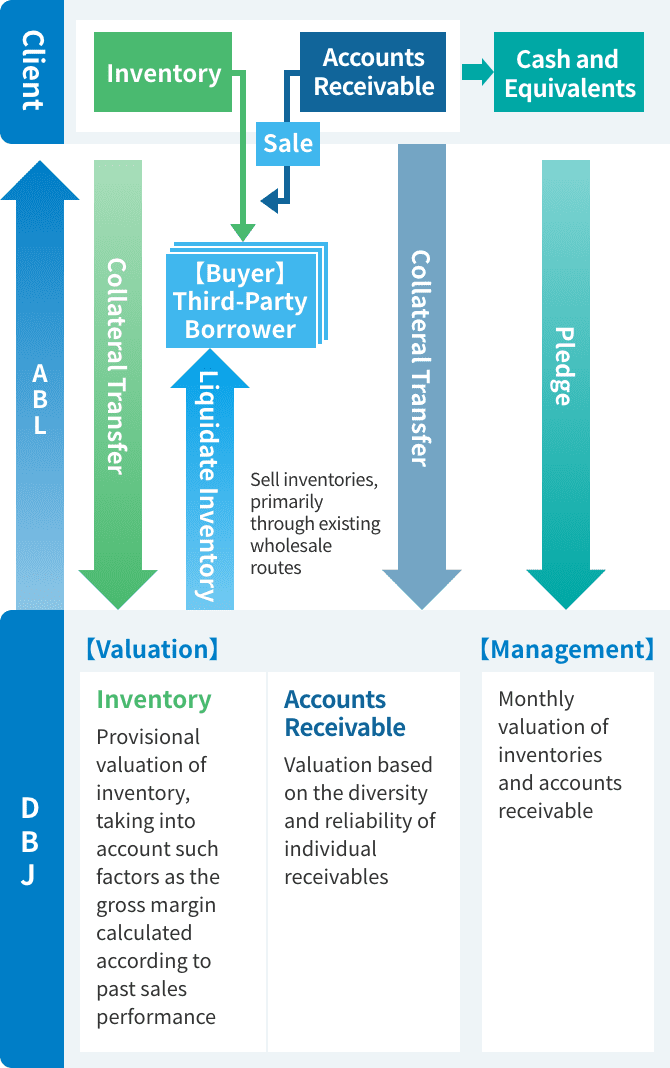

Asset based lending (ABL) is a financing method in which a borrower can use its liquid assets as collateral (collective personal property, inventory, accounts receivable, etc.).

For customers this method is beneficial mainly for the diversification of financing methods, flexibility of fundraising, reshuffling of debt, and fortification of the internal control system.

DBJ has a vast track record in the field of corporate revitalization financing, in which it leads other financial institutions. The Bank has developed and utilizes an ABL scheme with the objective of both supporting companies and securing their debt. Going forward, DBJ aims to use its scheme-building capabilities as a platform to deploy ABL schemes as a vehicle to provide growth capital to companies.

Scheme

Related information

- Service

- Medium- to Long-Term Loans

- Structured Finance

- Asset Financing (Real Estate)

- Syndicated Loans

- Asset-Based Lending (ABL)

- Debtor-in-Possession Financing

- Crisis Response Operations

- Mezzanine Financing

- LBOs / MBOs

- Equity

- Collaborative Fund Operations

- Special Investment Operations

- DBJ Sustainable Solutions(Open in new window)

- DBJ Certification Programs

- DBJ Sustainability Linked Loans with Engagement Dialogue

- DBJ Green Building Certification

- The DBJ Visionary Hospital Program

- Regional Emergency Response Program

- M&A Advisory Services

- Support for Startups

- Support for Innovation

- Public Asset Management

- Asset Management