Environmental Consciousness Through Investments and Financing

DBJ Certification Programs

Using its independently developed screening system, DBJ certification programs set the terms and conditions of loans based on corporations’ non-financial information.

DBJ launched the Environmentally Rated Loan Program in 2004, the first such program in the world. In 2006, DBJ launched the BCM Rated Loan Program to evaluate disaster preparedness and measures to ensure business continuation. Furthermore, in 2012 DBJ began to offer the Employees’ Health Management Rated Loan Program, which evaluates measures in health management. A major defining characteristic of DBJ certification programs is the assessment process that emphasizes face-to-face discussions, during which we directly inquire about clients’ initiatives that are not evident in their publicly disclosed information. Our screening sheet is reviewed every year in deliberations by the Advisory Committee composed of outside experts, who also take into consideration the latest issues and trends around the world.

As follow-up services, we create venues in the form of post-assessment award ceremonies at which companies’ top management can exchange their opinions with each other. In addition to feedback and details about the assessment results, we directly convey information about anticipated matters and examples of outstanding efforts at other companies, with the view of supporting more sophisticated initiatives in the future.

For customers using the BCM Rated Loan Program, we hold an annual event called the BCM Rated Loan Club as a venue for crisis managers to exchange opinions and information. Through its certification programs, DBJ broadly supports the initiatives of its customers while contributing to the formation of a sustainable society.

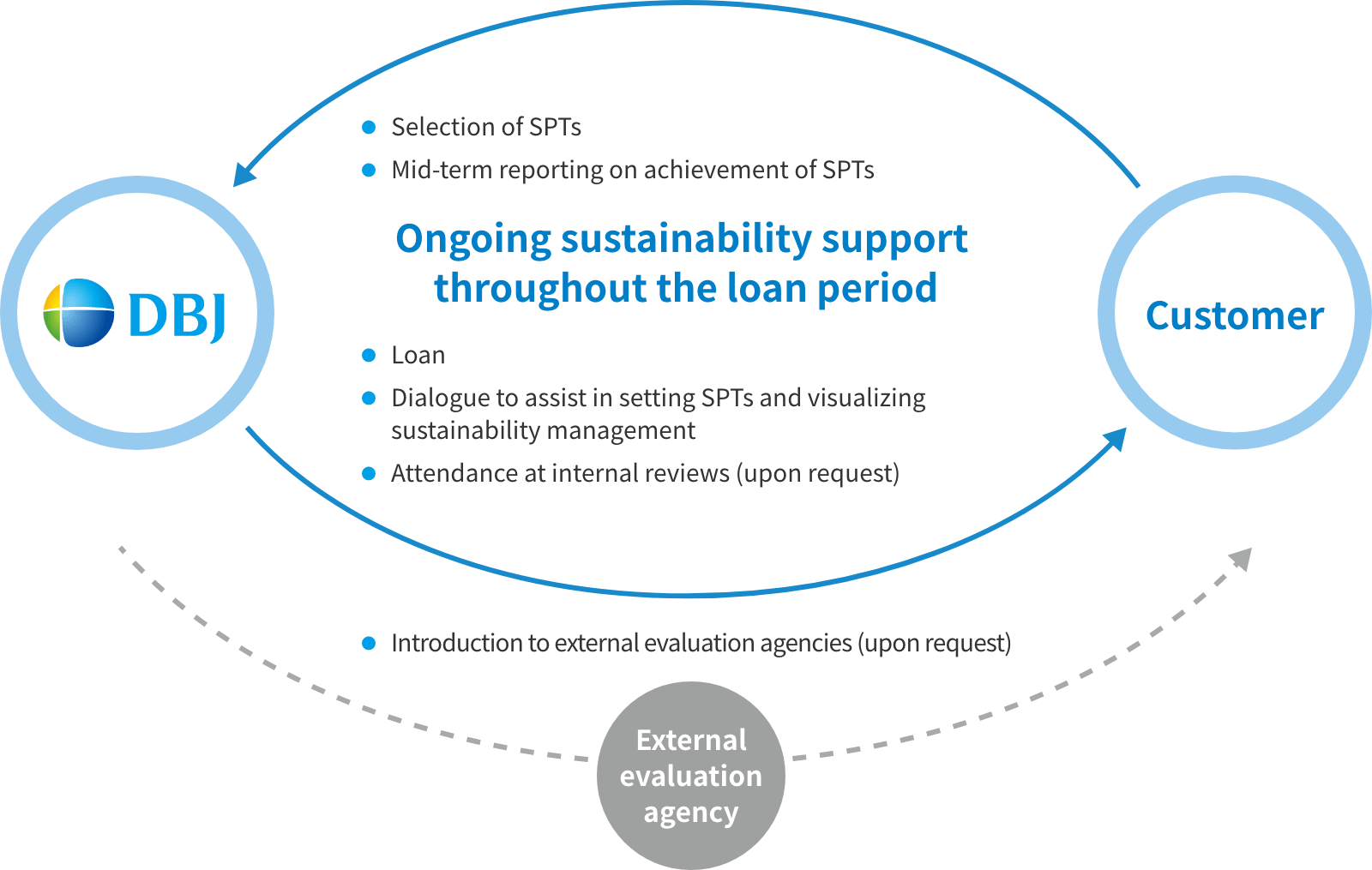

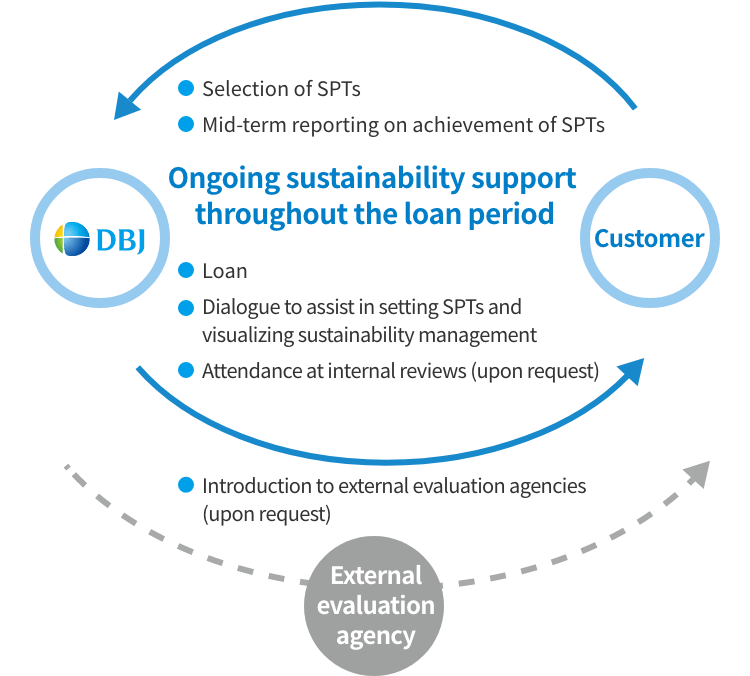

DBJ Sustainability Linked Loans with Engagement Dialogue

Sustainability linked loans are financial instruments whose aim is to achieve sustainable growth for both borrowers and society as a whole. Based on the Sustainability Linked Loan Principles drawn up by the Loan Market Association and the Green Loan and Sustainability Linked Loan Guidelines issued by the Ministry of the Environment, they work by incentivizing the linkage of loan terms and conditions to the achievement of targets – sustainability performance targets, or SPTs – consistent with the borrower's sustainability strategy.

Under DBJ sustainability linked loans with engagement dialogue, we engage with our borrowers to set the SPTs which can best motivate them to raise the level of their sustainability management and achieve the goals that the SPTs represent.

Customers benefit from visualizing sustainability initiatives through dialogue with DBJ while enjoying the positive publicity that comes with structuring a sustainability linked loan.

DBJ sustainability linked loans with engagement dialogue is one way in which we encourage sustainability management among our customers while promoting the growth of a sustainable society.

Conceptual diagram

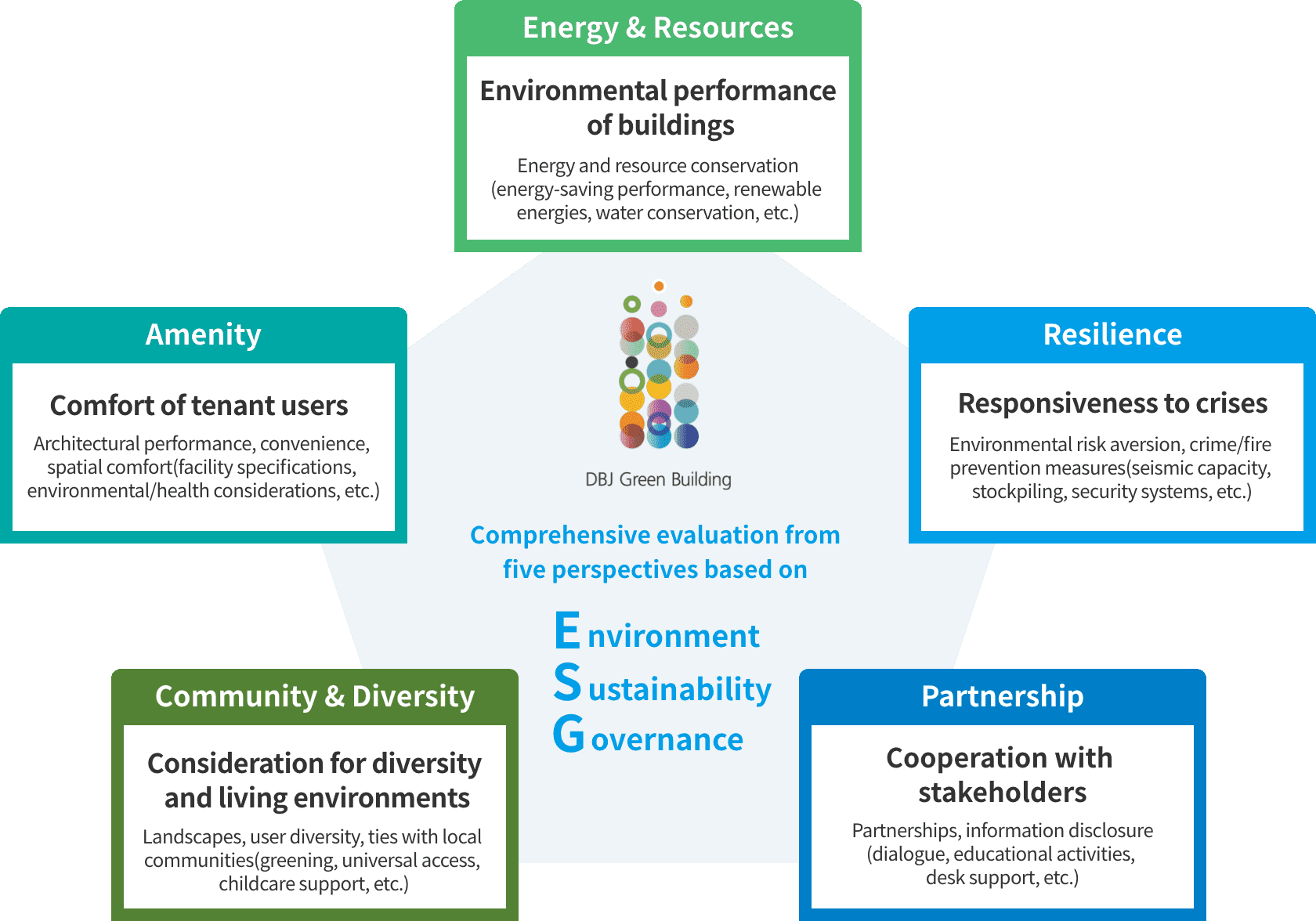

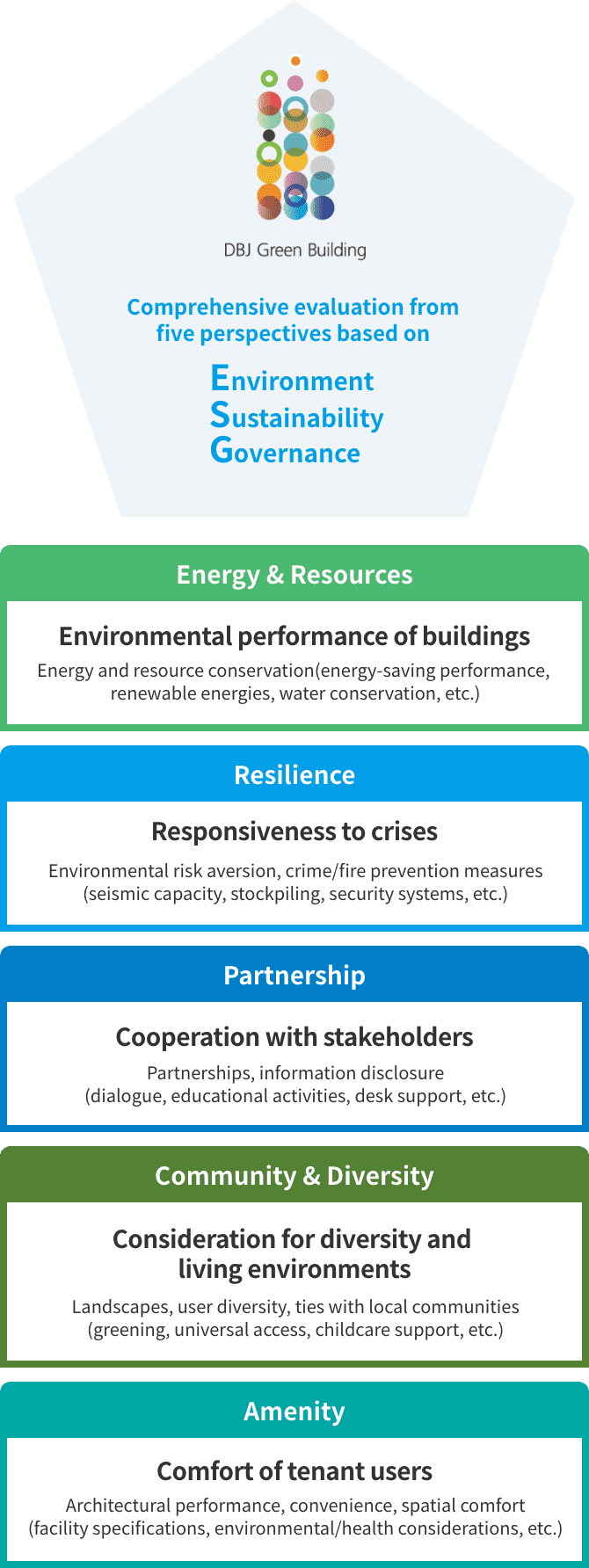

DBJ Green Building Certification

DBJ established the DBJ Green Building Certification system in fiscal 2011 by leveraging the knowhow and networks accrued over many years through real estate financing. This system evaluates and certifies real estate that places consideration on the environment and society (green buildings). Certification hinges on the environmental performance of the real estate, based on a comprehensive evaluation that includes the real estate’s support for various stakeholders, such as considerations for disaster prevention and the community. DBJ Green Building Certification promotes sustainability through investment that evinces environmental, social, and governance considerations.

Scheme

DBJ Asset Management Co., Ltd.

DBJ Asset Management (DBJAM) was established by DBJ in November 2006 to promote the vitalization of capital flows and the development of financial markets in Japan. Backed by DBJ’s corporate philosophy and strong financial resources, DBJAM specializes in alternative investments in real estate, private equity, and infrastructure.

Environmental concerns and sustainability are important issues for DBJAM, which gives consideration to environmental, social, and governance (ESG) factors in its investment decisions and post-investment monitoring. DBJAM thoroughly researches its investment targets and encourages them to take action where necessary. Its real estate business is governed by a sustainability policy under which concern for the environment, society, and governance is incorporated into every aspect of asset management. By raising the asset value of real estate over the medium to long term, DBJAM aims to contribute to the sustainable growth of the Japanese economy.

- Sustainability

- Sustainability News

- Message from the President

- Sustainability Management System

- Policy on Sustainability

- DBJ Group Human Rights Policy

- Value Creation Process

- Priority Areas for the Achievement of Vision 2030

- Resolving Social Issues and Creating Value Through Our Core Businesses

- Fundamental Activities

- Collaboration with Stakeholders