DBJ Sustainability Bond (Date of Issue:2015.10.21)

The net proceeds of the issuance of the Notes will be used exclusively to finance or re-finance, in whole or in part, existing and/or future Eligible Loans (as defined below).

"Eligible Loans" means loans e (i) loans extended by DBJ to companies that are rated A, B or C under the DBJ Environmentally Rated Loan Program, or (ii) loans extended by DBJ to finance or refinance buildings that are rated 3, 4 or 5 stars under the DBJ Green Building Certification program and which have not previously been the subject of the use of proceeds of DBJ's Existing Green Bonds (as defined below).

"Existing Green Bonds" means DBJ's Series 53 EUR250,000,000 0.25 per cent. Notes due 2017.

DBJ Environmentally Rated Loan Program is a loan program utilizing a screening (rating) system developed by DBJ that evaluates enterprises on the level of their environmental management and then sets financial conditions based on these evaluations. This was the world's first incorporation of environmental ratings in financing menus.

DBJ Green Building Certification is an environmental and social rating system created and applied by DBJ to measure the environmental and social awareness characteristics of real estate properties. DBJ Green Building Certification assesses the characteristics of a green building from perspectives such as ecology, risk management & amenity and community & partnership (please see the DBJ Green Building Certification for more information).

Sustainalytics PTE LTD provides an independent third-party opinion to the DBJ Sustainability Bond (please see the Opinion (PDF 967K)for the opinion).

The net proceeds from the issue of the Notes will be held and tracked in DBJ's treasury until they are allocated to Eligible Loans. So long as the Notes are outstanding, DBJ aims to allocate an amount equivalent to the net proceeds of the Notes towards Eligible Loans. Unallocated proceeds will be held in cash and/or a money-market portfolio which will be tracked by DBJ's treasury.

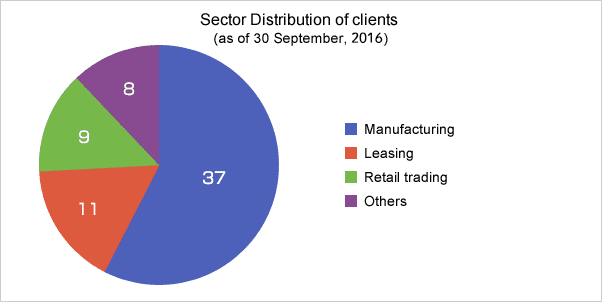

DBJ will disclose, on an annual basis, the total amount of loans provided under the Environmentally Rated Loan Program and Green Building Certification programs and the number of loans granted using the Sustainability Bond proceeds. In addition, in the case of the Green Building Certification program where it has received client’s consent, DBJ will disclose two or three case studies of green buildings underlying the loans allocated to Eligible Loans. In the case of the Environmentally Rated Loan Program, DBJ will report the sector distribution of clients and, in cases in which it has received a client’s consent, it may report project summaries and key factors evaluated on specific green projects undertaken or implemented by the client.

Eligible Assets for this DBJ Sustainability Bond are loans extended from April 2014 to September 2015, and the assets are listed below. The total amount of the Eligible Assets for the Note is ¥ 116 billion (Approx. €1,027 million (¥ 113.36=€1.00)) as of September 30, 2016.

Eligible Assets

(i) DBJ Environmentally Rated Loan Program

(as of 30 September, 2016)

the number of Eligible Assets:65

the total amount outstanding:¥97 billion (Approx. €855 million (¥113.36=€1.00))

Case study

Suzuki Motor Corporation (Shizuoka)

Manufacturing Company

Rating (DBJ Environmentally Rated Loan Program):A

Currency:JPY

Features of the Assessment

- Suzuki has placed a strong emphasis on the environmental effect of its products in use. Applying some of the strictest standards such as Top Runner Standards, the company promotes Suzuki Green Technology, a next-generation environmental technology aimed at reducing weight and fuel consumption. As a result, the company provides products that create new demand, while at the same time addressing an issue facing society.

- To reach increasing numerical targets for higher global average fuel economy, the company has set key performance indicators (KPIs) for the development of environmental technologies based on a medium-term roadmap. These KPIs lead to the development of next-generation vehicles and improvements in technologies for enhancing fuel performance.

- The company conducts monthly environmental effect analyses of each of its production lines and processes, and uses energy cost conversions to measure annual results of introducing equipment. These measures help to ensure the thorough visualization of environmental effects and lead to thorough environmental measures at every plant.

- In addition to having in place a system to centrally manage the environmental risk of its procurement partners, the company has introduced Suzuki’s Environmental Management System for sales distributors to promote environmental awareness throughout the supply chain.

Santen Pharmaceutical Co., Ltd. (Osaka)

Manufacturing Company

Rating (DBJ Environmentally Rated Loan Program):A

Currency:JPY

Features of the Assessment

- To reflect the stance of ISO 26000, Santen's Values define the “7 Core Subjects of CSR” as important social issues to address in its corporate activities. In line with these subjects, the company engages in dialogue with its stakeholders and considers specific initiatives to address in each of these areas.

- In terms of product quality, Santen Pharmaceutical has established its own standards that exceed statutory requirements. The company has adopted water resource measures as an important theme of its environmental activities, as these resources can significantly affect its quality control. Accordingly, the company takes a proactive stance toward conserving water resources through forest preservation activities.

- In addition to imposing strict process controls to reduce its percentage of non-conforming products and working to reduce waste, Santen Pharmaceutical has set targets for its final disposal rate that surpass industry levels. The company is also committed to promoting further 3R (reduce, reuse and recycle) activities.

Fuyo General Lease Co., Ltd. (Tokyo)

Leasing Company

Rating (DBJ Environmentally Rated Loan Program):A

Currency:JPY

Features of the Assessment

- After each lease period is complete, goods are sent to Fuyo’s 3 R Center for appropriate disposal. The company also provides a buyback service for used goods, thus ensuring the effective use of its own property and that of others.

- Since FY 2014, Fuyo has promoted the spread of eco-friendly properties and services by working to achieve interim numerical targets for new CSR activities.

- Through environmental accounting, the company tabulates its effectiveness in reducing environmental burdens on the user side and published its findings. It also discloses indexes on social reports, such as numbers of female managers and percentage of disabled employees, encouraging dialogue with stakeholders within and outside the organization by enabling them to visualize the company’s CSR activities and their results.

(ii) DBJ Green Building Certification

(as of 30 September, 2016)

the number of Eligible Assets:11

the total amount outstanding:¥19 billion (Approx. €171 million (¥113.36=€1.00)).

Case study

Shin-Daibiru Building/DAIBIRU CORPORATION

Prize (DBJ Green Building Certification 2014):5 Stars

Currency:JPY

Features of the Assessment

- Energy-efficient operation is ensured by LED lighting throughout the structure and a Building and Energy Management System (BEMS)*.

- The building provides the kind of high-quality office environment that tenants demand. Features including private conference rooms ensure a high level of comfort, while vibration-control construction and 72-hour emergency generators support safety and business continuity.

- By preserving the old building’s rooftop plantings, objets d’art, and other items of historic significance, the Shin-Daibiru Building contributes to the community and the region as a whole.

*BEMS: A system which cuts the energy consumption of a building through management of its facilities and equipment.

| Location | Osaka-shi Osaka Prefecture |

|---|---|

| Initial Certification Date | Mar 2015 |

| Site Area | 8,427m² |

| Floor Area | 77,388m² |

| Number of stories | 31 stories above ground |

| Construction Completion | Mar 2015 |

GLP Tokyo II/GLP J-REIT

Prize (DBJ Green Building Certification 2014):5 Stars

Currency:JPY

Features of the Assessment

- LED lighting and illumination control systems are among the facilities’ many energy-saving devices. Management ensures excellent energy efficiency through energy-sharing and other initiatives designed to keep tenants well-informed about energy conservation issues.

- Consistent efforts are made to create a pleasant place in which to work. Relaxation spaces, shops and other facilities are provided for tenants’ employees, and surveys are carried out to measure customer satisfaction.

- Large-scale solar power and wind power generation systems are representative of the facilities’ environmentally aware design. With standby power and emergency goods on hand, the buildings are managed with great sensitivity to the need to protect the natural environment.

| Location | Koto-ku Tokyo |

|---|---|

| Initial Certification Date | Mar 2015 |

| Site Area | 31,998m² |

| Floor Area | 85,454m² |

| Number of stories | 7 stories above ground |

| Construction Completion | Apr 2006 |

mozo wondercity/Japan Retail Fund Investment Corporation

Prize (DBJ Green Building Certification 2014):4 Stars

Currency:JPY

Features of the Assessment

- The designers showed strong interest in saving energy and resources and in reducing environmental burdens overall. Buildings use LED lighting in all the common areas; atriums and glass walls let in natural light, and greenery covers many exterior walls.

- Every effort was made to make the facilities as attractive as possible: tenants were attracted to cater for a variety of consumer needs, and features introduced to make the shopping experience enjoyable for all visitors, from children to seniors.

- Shoppers taking public transport from the nearest train station to mozo wondercity get points which can be used for purchases at the facility.

| Location | Nagoya-shi Aichi Prefecture |

|---|---|

| Initial Certification Date | Nov 2014 |

| Site Area | 107,456m² |

| Floor Area | 233,606m² |

| Number of stories | 6 stories above ground, 1 story below ground |

| Construction Completion | Aug 2007/Apr 2009 |