Investing in Life Science Venture Capital Funds in Japan, US and Europe

- Industrial Sectors

- Investing

- Americas

- Europe/Africa

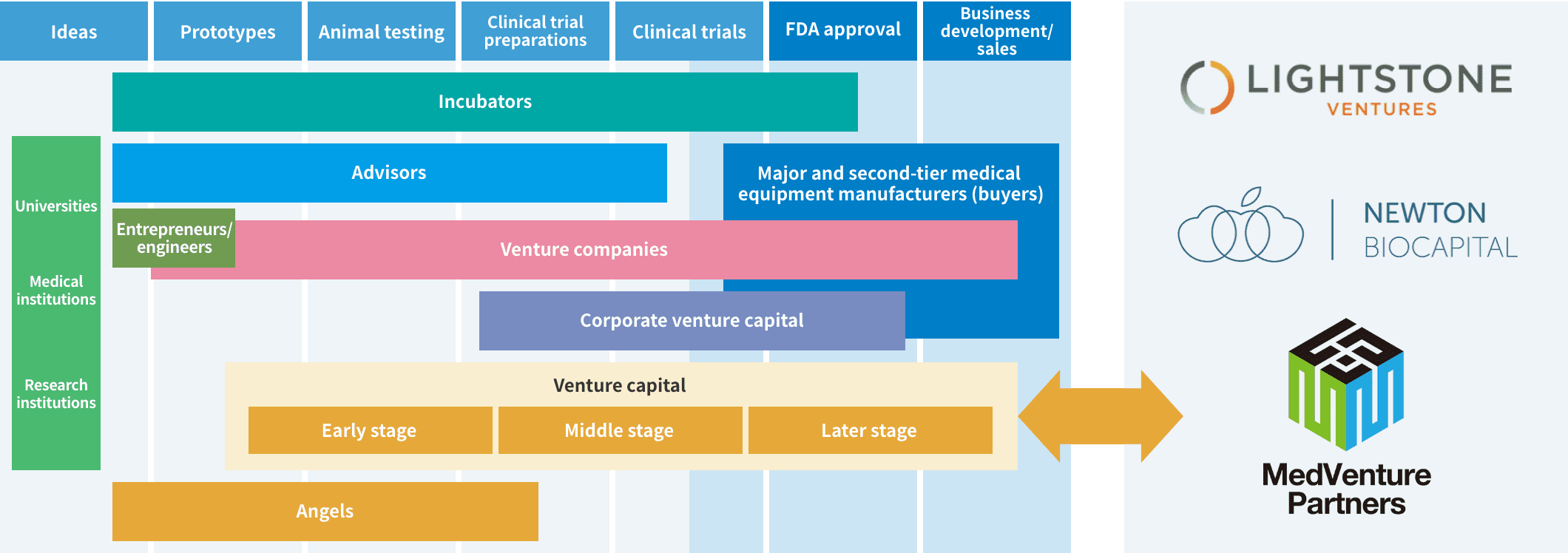

In the medical device and pharmaceutical sectors of the life sciences, significant impacts arise out of not only in-house development but also acquisitions and alliances with large-scale companies. Companies in these sectors must regularly review their business development plans accordingly, and all stakeholders must further develop the burgeoning life sciences ecosystem to facilitate the delivery of new technologies.

In between 2017 and 2019, DBJ invested in (1) Lightstone Ventures II, L.P., which invests in pharmaceutical/medical device ventures in the US, (2) Newton Biocapital I pricaf privée SA,which invests in pharmaceutical/medical device ventures in Japan and Europe, and (3) MPI-2 Investment Limited Partnership, a fund that invests in medical device ventures in Japan, the US, and elsewhere.

Through investment in these funds, DBJ is able to learn about the ecosystems in various regions around the world, as well as serve as a bridge between foreign ventures and major Japanese companies and support the development of domestic venture capital firms. The goal is to contribute to the development of a life science ecosystem in Japan.