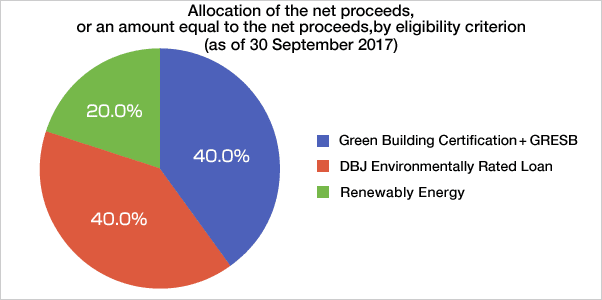

DBJ Sustainability Bond (Date of Issue:2017.10.18)

The net proceeds, or an amount equal to the net proceeds, of the issuance of this DBJ Sustainability Bond will be allocated, by way of various financial instruments, exclusively to finance or refinance, in whole or in part, existing and/or future projects or businesses which meet the following Eligibility Criteria (the “DBJ Sustainability Bond Eligibility Criteria”):

-

(1)

Loans to companies that are rated A, B or C under the DBJ Environmentally Rated Loan Program.

-

(2)

Funds to finance or refinance buildings that are rated 3, 4 or 5 stars under the DBJ Green Building Certification Program (“GBC”) .

-

(3)

Funds to finance or refinance companies, buildings, real estate properties or REITs that have a ‘Green Star’ rating under the GRESB evaluation framework.

-

(4)

Funds to finance or refinance renewable energy projects:

- Financing or Refinancing construction and/or operation of solar, wind (onshore and offshore), biomass, geothermal, run-of-river hydropower, and tidal and wave power assets

-

(5)

Funds to finance or refinance clean transportation projects or loans to companies exclusively for use for clean transportation projects:

- Installation and/or maintenance of energy-efficient and/or electric trains

- (Re)construction, extension, maintenance, and/or upgrade of rail lines

- (Re)construction, maintenance, operation and/or upgrade of railway systems and assets

- Infrastructure and components which could help increase the transport capacity and improve the efficient movement of people and freight

The financing(s) satisfying the DBJ Sustainability Bond Eligibility Criteria is(are) defined as the “Eligible Financing(s)”. The Eligible Financings will not include the eligible assets to which the net proceeds, or an amount equal to the net proceeds, have been allocated from the issuance of the existing DBJ Sustainability Bonds: the DBJ's Series 56 (EUR300,000,000, 0.375%, due 2019) and DBJ’ Series 63 (USD500,000,000, 2.000%, due 2021).

The net proceeds, or an amount equal to the net proceeds, from the DBJ Sustainability Bond issuance will be held and tracked in DBJ's treasury until they are allocated to the eligible projects and/or businesses. So long as the DBJ Sustainability Bond is outstanding, DBJ aims to fully allocate an amount equal to the net proceeds of the DBJ Sustainability Bond towards the eligible projects and/or businesses. Unallocated proceeds will be held in cash and/or a money-market portfolio which will be tracked by DBJ's Treasury Department. DBJ has internal management systems to track the amount of funds allocated to each of the Eligible Financings.

More details about the DBJ Sustainability Bond framework are available with a reference to the independent third-party opinion report (PDF 1.2M) PDF (dated September 1st, 2017) provided by Sustainalytics PTE LTD.

As of the end of October 2017, the allocation in full of the net proceeds, or an amount equal to the net proceeds, from the issuance of the current DBJ Sustainability Bond (due 2022) have been complete, and the share of refinancing is 100%.

For more details about the Eligible Financings to which the net proceeds, or an amount equal to the net proceeds, from the bond issuance have been allocated, please click on each of the following links .